Executive Summary

The American consumer of 2024 is a transformed entity. The seismic shocks of the COVID-19 pandemic, followed by a period of historic inflation and geopolitical uncertainty, have fundamentally rewired spending habits, redefined the meaning of “value,” and reshuffled life’s priorities. This is not a temporary shift but a permanent evolution. Businesses that fail to understand this new landscape risk irrelevance. This deep-dive analysis moves beyond surface-level trends to explore the core psychological and economic drivers shaping consumer behavior. We will dissect the “Cautious Optimist” persona, the fusion of financial pragmatism with a demand for experience, the rise of “health” as a holistic currency, and the digital-first, yet community-oriented, mindset that defines this era. Success in the 2024 market requires a strategic pivot from simply selling products to aligning with the deeply held values and calculated financial logic of the modern American consumer.

1. Introduction: The Great Recalibration

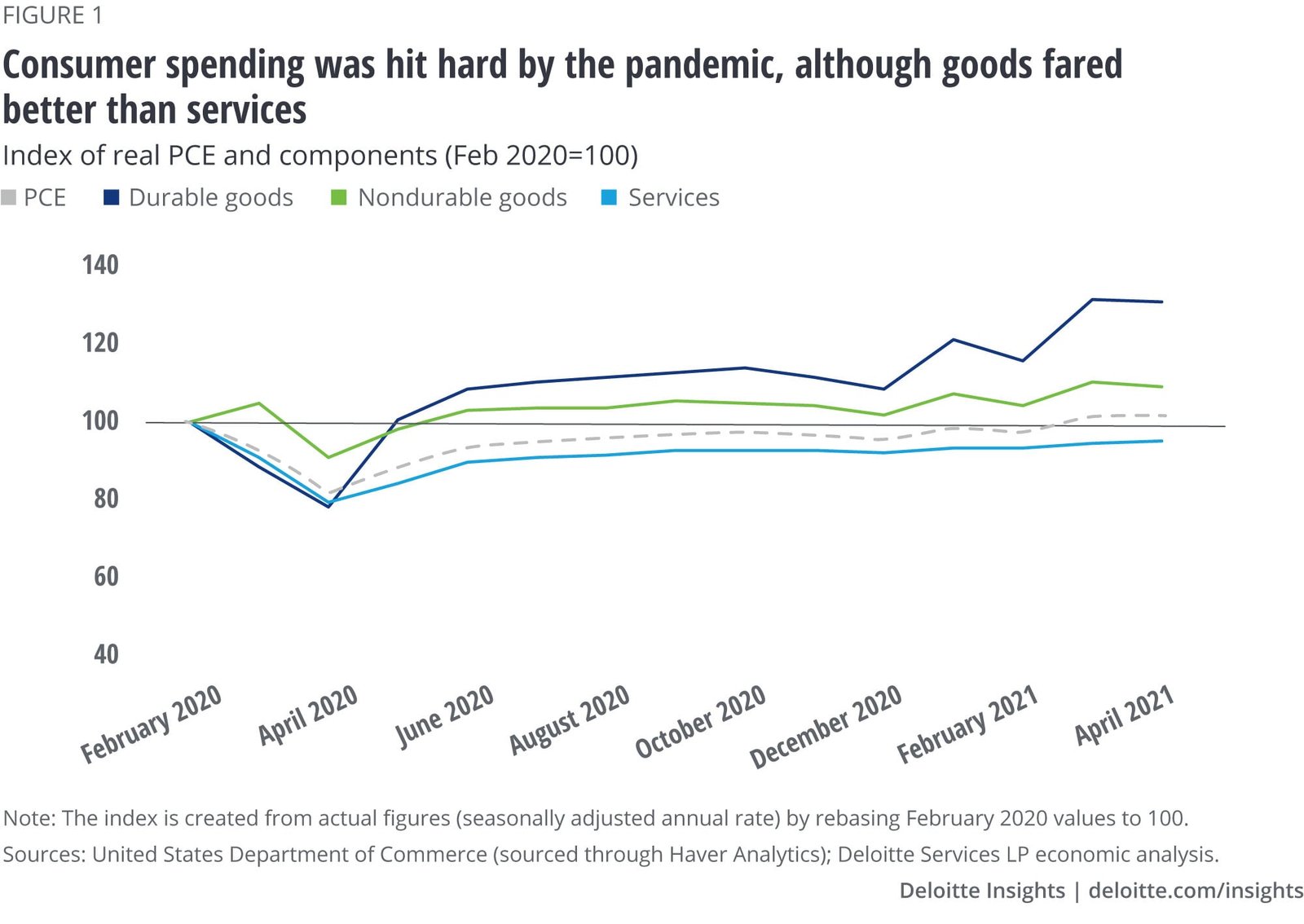

The period from 2020 to the present has been more than a mere economic cycle; it has been a profound social and psychological crucible for the American public. The pandemic-induced lockdowns, the subsequent supply chain chaos, and the highest inflation rates in four decades have collectively acted as a forcing function for change. The “normal” of 2019 is a distant memory, replaced by a market characterized by what we term “The Great Recalibration.”

This report synthesizes data from government sources (U.S. Bureau of Labor Statistics, Census Bureau), leading market research firms (McKinsey, Pew Research Center, Gartner), and consumer sentiment surveys to build a nuanced profile of the 2024 consumer. Our analysis is grounded in the recognition that behavior is driven by a complex interplay of financial reality and evolving personal values. The consumer who emerges from this analysis is not a monolith but a sophisticated, data-savvy, and intentional actor navigating a transformed world.

2. The Macro-Economic Backdrop: A Lingering Hangover

To understand the consumer, one must first understand the economic pressures they face.

- Inflation and The Squeeze on Discretionary Income: While the blistering pace of inflation has cooled from its 2022 peak, the cumulative effect of price increases on essentials like housing, groceries, and utilities has created a permanent dent in household budgets. The Consumer Price Index (CPI) data shows that prices for a broad basket of goods remain significantly higher than pre-pandemic levels. This has led to a phenomenon known as “shrinkflation” becoming a common consumer grievance, further eroding perceived value.

- The Interest Rate Environment: The Federal Reserve’s aggressive interest rate hikes have made borrowing more expensive, cooling the housing market and making large-ticket purchases on credit (e.g., cars, appliances) less accessible for many. This has forced a shift towards saving and delayed gratification.

- A Resilient, Yet Anxious, Labor Market: The job market has remained surprisingly robust, with low unemployment rates. However, this coexists with widespread anxiety about job security, the impact of artificial intelligence on certain roles, and the need for continuous upskilling. This creates a “cautiously employed” mindset, where financial optimism is tempered by prudence.

3. The Emergence of the “Cautious Optimist” Consumer Persona

The dominant consumer archetype of 2024 is the “Cautious Optimist.” This persona is defined by a dual mindset:

- The “Cautious” Half: This is the financially pragmatic, research-driven, and value-obsessed consumer. They are hyper-aware of their spending, compare prices across multiple platforms, and are quick to abandon brands that fail to deliver clear, tangible value. Loyalty is earned, not given.

- The “Optimist” Half: Despite the financial pressure, there is a strong desire to live fully. The pandemic was a stark reminder of life’s fragility. This has fueled a “you-only-live-once” (YOLO) mentality for experiences that align with personal values. However, this is not the reckless spending of the past; it is calculated indulgence.

This persona’s behavior is not contradictory but rather a sophisticated coping mechanism. They will aggressively cut back on non-essential goods to save up for a meaningful vacation or a premium wellness product that contributes to their long-term well-being.

4. Core Value #1: The New Calculus of Value & Frugality

“Value” has been redefined. It is no longer just a low price tag. The 2024 consumer engages in a multi-variable calculus where value is a function of Cost, Quality, Durability, and Ethical Alignment.

- Trading Down and Trading Up: Consumers are strategically “trading down” on categories they deem low-priority or commoditized. This means opting for private-label brands at the grocery store, canceling redundant streaming subscriptions, and seeking discounts on generic household items. Simultaneously, they are “trading up” on categories central to their identity and well-being. This includes premium fitness memberships, high-quality, sustainably sourced food, and trusted skincare products.

- The Resurgence of Generic and Private Label: Data from the Food Industry Association (FMI) shows private-label brand sales have hit record highs as consumers recognize their quality has improved significantly, offering comparable quality at a lower price point.

- The Subscription Reckoning: The era of accumulating countless subscriptions is over. Consumers are now conducting regular “subscription audits,” ruthlessly cutting services they do not use frequently. This forces companies like Netflix, Disney+, and countless SaaS providers to constantly prove their ongoing value.

5. Core Value #2: Health & Wellness as a Holistic Pursuit

The pandemic made health a universal priority, but its definition has expanded far beyond “not being sick.” Health is now a holistic, multi-dimensional pursuit encompassing physical, mental, and emotional well-being.

- Physical Health: The focus has shifted from reactive treatment to proactive prevention. This fuels markets for:

- Functional Foods & Beverages: Products with added probiotics, adaptogens, and enhanced nutritional profiles.

- Fitness Technology: The integration of wearables (Apple Watch, Oura Ring) and fitness apps into daily life for data-driven health monitoring.

- Personalized Nutrition: The rise of services like personalized vitamin subscriptions (e.g., Ritual) and DNA-based diet plans.

- Mental & Emotional Wellness: This is one of the most significant growth areas. Consumers are actively investing in:

- Mental Health Apps: Platforms like Calm and Headspace have moved from niche to mainstream.

- Sleep Optimization: A booming market for sleep trackers, weighted blankets, and specialized mattresses.

- Stress-Reduction Activities: Demand for yoga, meditation retreats, and leisure activities that promote digital detox.

6. Core Value #3: The Demand for Authenticity & Purpose

Today’s consumer expects the brands they support to stand for something beyond profit. This is not a niche preference for millennials; it is a mainstream expectation.

- Transparency as Table Stakes: Consumers investigate supply chains, labor practices, and environmental impact. Brands like Patagonia and Allbirds have built their entire identity on radical transparency, forcing larger incumbents to follow suit.

- Action, Not Activism-Washing: Empty marketing slogans are met with cynicism. Consumers reward brands that take tangible, verifiable action. This includes committing to verifiable sustainability goals (e.g., carbon neutrality, plastic reduction), ethical sourcing, and fair labor practices.

- Community Connection: There is a strong desire to support local businesses and brands that foster a genuine sense of community. The “localvore” movement (buying local) gained momentum during lockdowns and has retained a significant foothold, as it offers authenticity, unique products, and a tangible connection to the community.

Read more: Retirement Planning in 2025: What You Need to Know

7. Core Value #4: The Seamless Digital-Physical Fusion

The digital adoption forced by the pandemic is now a permanent and sophisticated part of the consumer journey. The line between online and offline is not just blurred; it is functionally irrelevant.

- The Omnichannel Mandate: Consumers fluidly move between channels. They will research a product on their phone, check reviews on a laptop, see it in-store, and then purchase it via the retailer’s app for in-store pickup. A frictionless experience across all these touchpoints is non-negotiable.

- The Rise of Social Commerce & Influencer Validation: Platforms like TikTok Shop and Instagram Checkout have turned social media into a direct sales channel. However, consumers are savvy; they rely on micro-influencers and real-user-generated content for authentic validation over celebrity endorsements.

- Data Privacy as a Value Exchange: While consumers enjoy personalization, they are increasingly aware of their data’s value. They are willing to share data if they receive a clear, fair value exchange—such as highly relevant recommendations, exclusive discounts, or a smoother user experience.

8. Actionable Strategies for Businesses

How can companies adapt to thrive in this new environment?

- Embrace Radical Value Transparency: Clearly communicate why your product is worth the price. Break down the cost: quality materials, ethical manufacturing, durability. Use data to show cost-per-use for long-lasting items.

- Develop a “Cautious Optimist” Product Portfolio: Balance your offerings. Include value-tier products to meet “trading down” behavior while also innovating in premium, experience-driven categories for “trading up.”

- Integrate Holistic Wellness: Even if you are not in the health industry, consider how your product or service contributes to well-being. This could be through ergonomic design, promoting work-life balance for your employees (as a brand value), or creating calming, uncluttered retail environments.

- Operationalize Your Purpose: Weave your brand’s purpose into every business operation. Set and publicly report on ESG (Environmental, Social, Governance) metrics. Support local communities with action, not just donations.

- Invest in Frictionless Omnichannel Infrastructure: Ensure your website, app, and in-store experiences are fully integrated. Implement systems like BOPIS (Buy Online, Pick Up In-Store) and easy, transparent return policies across channels.

- Build Community, Not Just a Customer List: Foster genuine engagement through user-generated content campaigns, loyalty programs that offer experiences (not just points), and creating spaces—online or physical—where your customers can connect with each other.

Read more: AI for Trading: The 2025 Complete Guide

9. Conclusion: The Intentional Future

The American consumer in 2024 is more intentional, more informed, and more values-driven than at any point in recent history. The Great Recalibration has replaced impulsive consumption with purposeful allocation. The businesses that will win their loyalty are those that recognize this fundamental shift. Success is no longer just about the functional attributes of a product; it is about the brand’s ability to authentically align with the consumer’s complex calculus of financial prudence, holistic well-being, and ethical conviction. The future belongs to those who can serve the “Cautious Optimist” not as a demographic, but as a mindset.

FAQ Section

Q1: Is this shift in consumer behavior permanent, or will we see a return to pre-pandemic spending habits?

Most indicators suggest this is a permanent structural shift, not a temporary phase. The pandemic, high inflation, and geopolitical events were profound enough to fundamentally rewire consumer psychology and financial habits. While certain behaviors may moderate, the core values of calculated spending, a demand for authenticity, and a focus on holistic wellness are now deeply embedded.

Q2: Which generations are driving these changes the most?

While Millennials and Gen Z are at the forefront of trends like the demand for sustainability and digital fluency, the economic pressures of inflation and the shared experience of the pandemic have influenced all generations. Baby Boomers and Gen X are also adopting more digital tools and becoming more value-conscious, making this a broad-based, cross-generational shift.

Q3: How can a small business with limited resources compete on values like sustainability and transparency?

You don’t need the budget of a multinational corporation to be authentic. Start small and be specific.

- Transparency: Be open about your sourcing. Feature the stories of your local suppliers on social media.

- Sustainability: Make one tangible change, like switching to biodegradable packaging, and communicate it clearly to your customers.

- Community: Partner with another local business for a cross-promotion or event. For small businesses, authenticity and local connection are inherent competitive advantages.

Q4: With consumers “trading down,” how can premium brands justify their price point?

Premium brands must move beyond marketing “luxury” and instead articulate a compelling “value proposition.” This means:

- Highlighting Durability & Cost-Per-Use: “This jacket costs more upfront, but its lifetime warranty and timeless design mean you’ll own it for decades.”

- Emphasizing Provenance & Craftsmanship: Showcase the artisanal skills, superior materials, and ethical production behind the product.

- Fostering an Exclusive Community: Create a sense of belonging and status through loyalty programs and exclusive events.

Q5: What is the single most important takeaway for marketers in 2024?

Authenticity is the new currency. Consumers have highly developed “marketing BS” detectors. Ditch the generic campaigns and focus on building genuine trust by demonstrating your brand’s values through consistent, verifiable actions across every touchpoint.

Disclaimer: This market analysis is based on current data and trends as of 2024. It is intended for informational and strategic planning purposes. The economic and consumer landscape is dynamic, and continuous monitoring is recommended.

Read more: Trekking pants for mountain sports and adventure travel