Interest rates, set by central banks like the Federal Reserve, are the fundamental pulse of the global economy, directly dictating the cost of borrowing and the reward for saving. This article demystifies how even a slight change in rates sends powerful shockwaves through every financial market—from stocks and bonds to real estate and currencies. We explore the mechanics behind these fluctuations, analyze historical examples like the Volcker Shock of the 1980s and the 2022-2023 hiking cycle, and provide actionable insights for investors to navigate both rising and falling rate environments. Understanding this relationship is paramount for protecting and growing your wealth.

The Role of Interest Rates in Financial Market Fluctuations: A Complete Investor’s Guide

If the financial markets are a vast, global ocean, then interest rates are the moon that governs its tides. They are an invisible yet omnipresent force, pulling capital in and out of assets, lifting some boats while sinking others. For any investor, saver, or borrower, understanding the profound relationship between interest rates and market movements isn’t just academic—it’s a critical survival skill.

But what exactly is this mechanism? How can a decimal-point change by a distant committee of economists in Washington, D.C., cause your stock portfolio to swing by thousands of dollars or alter the mortgage rate on your dream home?

This definitive guide will dissect the role of interest rates in financial market fluctuations. We will move beyond the jargon to uncover the core principles, illustrate them with real-world examples from recent history, and equip you with a framework to make smarter financial decisions, no matter which way the economic winds are blowing.

What Are Interest Rates and Who Really Controls Them?

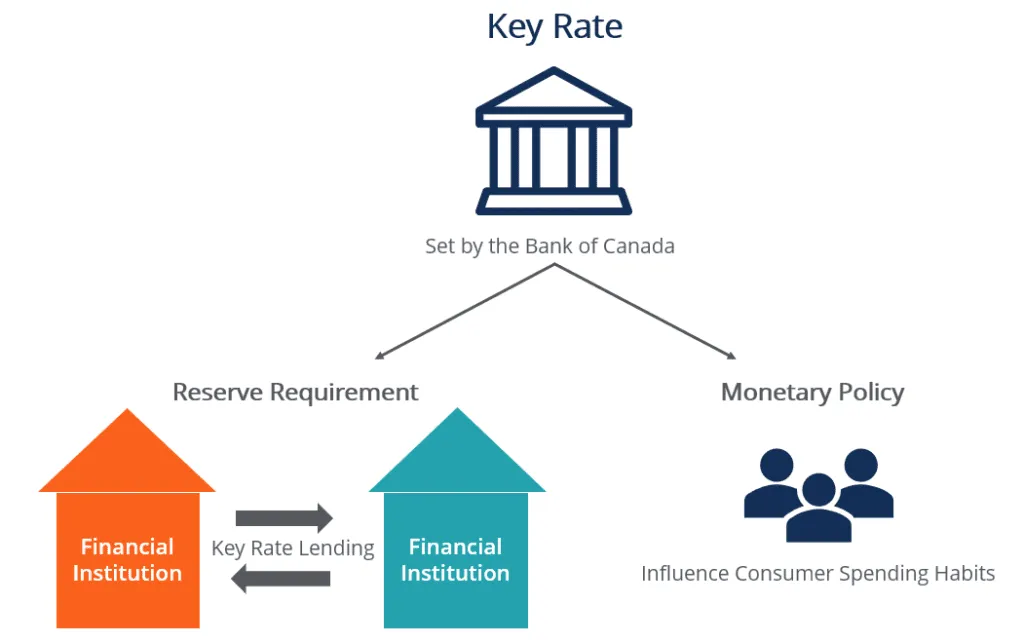

At its simplest, an interest rate is the price of money. It’s the cost you pay to borrow capital (like for a car loan) or the reward you receive for lending your money (like with a savings account). However, when we discuss rates that “move the market,” we’re primarily referring to the benchmark rates set by a nation’s central bank—in the United States, the Federal Reserve (the Fed).

The Fed’s primary tool is the federal funds rate, which is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight. While you and I can’t borrow at this rate, it acts as the foundation for the entire pyramid of credit in the economy, influencing everything from the interest on your credit card to the yield on a 30-year Treasury bond.

The Fed adjusts this rate to achieve its dual mandate: maximum employment and stable prices (typically targeting 2% inflation). When the economy is overheating and inflation is high, the Fed raises rates to cool things down. When the economy is in a recession, the Fed lowers rates to stimulate borrowing and spending.

Key Takeaway: The Federal Reserve is the conductor of the interest rate orchestra. Its decisions on the federal funds rate ripple out to every corner of the financial system, setting the tone for the cost of all credit.

The Fundamental Mechanics: How Interest Rates Move Markets

To understand the “why,” we need to grasp a few core financial concepts. Interest rates influence markets through several powerful channels.

1. The Time Value of Money (TVM)

This is the most crucial concept. TVM states that a dollar today is worth more than a dollar tomorrow because it can be invested to earn a return. Interest rates are the specific measure of that return. When risk-free rates (like those on government bonds) rise, the value of future cash flows falls. This is particularly devastating for growth stocks, whose valuations are heavily dependent on profits expected many years from now.

2. The Risk-Return Tradeoff

Investors constantly weigh risk against potential return. When safe assets like Treasury bonds start paying 5%, a risky stock must offer a significantly higher potential return to justify the added risk. This causes a “rotation” out of riskier assets and into safer ones when rates climb.

3. The Economic Growth Engine

Lower rates make it cheaper for businesses to borrow for expansion (new factories, equipment, hiring) and for consumers to finance big-ticket purchases (houses, cars). This stimulates the economy. Conversely, higher rates slow down borrowing, spending, and investment, deliberately cooling economic activity to combat inflation.

4. The Currency Carry Trade

Higher interest rates in a country tend to attract foreign capital seeking better returns. This increases demand for that country’s currency, causing it to appreciate. A stronger dollar, for instance, can hurt the profits of U.S.-based multinational companies by making their goods more expensive overseas and reducing the value of their foreign earnings when converted back to dollars.

Interest Rates and Specific Asset Classes: A Deep Dive

Let’s translate these abstract mechanisms into their real-world impact on the major asset classes you likely own.

The Stock Market: A Complicated Love-Hate Relationship

The stock market’s reaction to interest rates is nuanced and often depends on the why behind the rate change.

- The Valuation Hammer: Higher rates directly pressure stock valuations, especially for long-duration assets. Let’s use a simple example. Imagine a tech company is expected to generate $100 in profit five years from now. To determine its value today, we “discount” that future $100 back to the present using a discount rate heavily influenced by risk-free interest rates.

- At a 2% Rate: The present value of that $100 is approximately $90.60.

- At a 5% Rate: The present value plummets to about $78.35.

This 15% drop in value for a single future cash flow illustrates why high-growth, technology-centric stocks (like those in the NASDAQ) often get hammered when the Fed is in a hiking cycle, as witnessed dramatically in 2022.

- Sectoral Shifts (The Winners and Losers):

- Losers (Rate-Sensitive Sectors): Real Estate (higher mortgage rates), Utilities (high debt loads), and Technology (long-duration growth) typically underperform.

- Winners (Rate-Resilient Sectors): Banks can benefit as they earn more on the spread between what they pay for deposits and what they charge for loans. Energy and consumer staples often hold up better because their earnings are tied to immediate, essential needs rather than distant future growth.

Real-Life Example: The 2022 Market Rout. In response to decades-high inflation, the Fed embarked on its most aggressive hiking cycle since the 1980s. The S&P 500 fell over 25%, and the NASDAQ (tech-heavy) cratered by over 33%. High-growth names like Meta (Facebook) and Tesla saw their valuations cut in half or more, perfectly illustrating the destructive power of rising rates on long-duration assets.

The Bond Market: A Direct and Predictable Inverse Relationship

The bond market is the most directly affected by interest rates. There is a fundamental and unbreakable rule: When interest rates rise, existing bond prices fall, and vice versa.

Why? Imagine you own a bond paying a fixed 2% annual coupon. If new bonds are issued paying 5%, no one will want to buy your 2% bond at its face value. To make it attractive, you must sell it at a discount. Its price falls until its effective yield to a new buyer is competitive with the new 5% bonds.

- Key Factors Influencing Bond Price Sensitivity:

- Duration: Bonds with longer maturities are far more sensitive to interest rate changes. A 30-year bond will experience a much larger price drop than a 2-year note for the same rate increase.

- Credit Quality: Riskier corporate (junk) bonds are less sensitive to rate moves and more sensitive to the economic outlook, as higher rates can increase the risk of default.

The Real Estate Market: The Mortgage Rate Connection

This is one of the most tangible impacts for everyday Americans. Most people buy homes with mortgages, and mortgage rates are closely tied to the yield on the 10-year Treasury note.

- When Rates Rise: The cost of a mortgage increases. This prices out a significant number of potential buyers, reducing demand. It also makes it more expensive for developers to finance new projects, constricting supply. The net effect is a cooling housing market, with slowing price appreciation or even price declines.

- When Rates Fall: Cheaper mortgages increase buying power and demand, often fueling housing booms. The post-2008 crisis era of near-zero rates was a direct catalyst for a massive, decade-long bull run in real estate.

Real-Life Example: The 2023 Housing Slowdown. As the Fed jacked up rates, the average 30-year fixed mortgage rate soared from around 3% in 2021 to over 7% in 2023. This dramatically slowed home sales activity and caused a sharp deceleration in price growth, as reported by the National Association of Realtors, demonstrating the immediate cooling effect of higher rates.

The Foreign Exchange (Forex) Market

As mentioned, higher interest rates attract foreign investment, increasing demand for a currency and causing it to appreciate. This dynamic is a key focus of “forex carry trades,” where investors borrow in a low-interest-rate currency (like the Japanese Yen) and invest in a high-interest-rate currency (like the U.S. Dollar) to capture the difference.

Real-Life Example: The Strong Dollar of 2022-2023. While the Fed was aggressively hiking, other major central banks (like the Bank of Japan and the European Central Bank) were slower to act or maintained ultra-loose policy. This interest rate differential propelled the U.S. Dollar Index (DXY) to its highest level in 20 years, creating headwinds for American multinational companies.

Case Studies in Interest Rate History: Lessons from the Past

History provides the ultimate proving ground for these theories. Let’s examine two pivotal periods.

The Paul Volcker Era (Early 1980s): Taming the Inflation Beast

Fed Chair Paul Volcker inherited an inflation crisis (peaking near 15%). He made the courageous and painful decision to raise the federal funds rate to an unprecedented 20% in 1981. The immediate effect was a severe recession and a brutal bear market. However, his actions successfully broke the back of inflation, establishing the Fed’s credibility and setting the stage for a long period of economic stability and a legendary bull market that followed. It was a stark lesson in short-term pain for long-term gain.

The 2008 Financial Crisis and the Zero-Lower Bound

In response to the Great Recession, the Fed slashed rates to near zero and embarked on a novel policy called Quantitative Easing (QE). QE involved the massive purchase of bonds to inject liquidity directly into the financial system. This pushed long-term rates down further and fueled a massive rally in both stocks and bonds for over a decade, as investors were forced into riskier assets to find any meaningful yield.

Frequently Asked Questions (FAQs)

Here are answers to the most common and trending questions Americans are asking about interest rates and the markets.

1. Why does the stock market sometimes go up when the Fed raises rates?

This seems counterintuitive but happens for two main reasons. First, the market is a forward-looking machine. It might rally on a rate hike if it was expecting an even larger increase (a “dovish hike”). Second, if the hike is seen as a necessary medicine to control inflation without crashing the economy (a “soft landing”), confidence can return, and stocks can rise.

2. What is the “dot plot” and why do investors obsess over it?

The dot plot is a chart released by the Fed after its meetings that shows each Fed official’s projection for where interest rates will be in the future. It doesn’t represent a official promise, but it provides crucial insight into the Fed’s collective thinking, making it a key piece of intelligence for investors.

3. How do higher interest rates actually fight inflation?

They work by reducing demand across the economy. Higher rates make loans for cars, houses, and business expansion more expensive. This causes people and companies to spend less. As demand cools, businesses are forced to stop raising prices, and inflation gradually subsides.

4. Where should I invest my money when interest rates are rising?

Consider shifting towards:

- Short-term bonds and CDs (to capture higher yields with less price risk).

- Value stocks over growth stocks.

- Sectors that benefit from higher rates, like financials.

- Keeping a healthy amount of cash in high-yield savings accounts.

5. What’s the difference between real and nominal interest rates?

The nominal rate is the stated rate (e.g., a 5% bond). The real interest rate is the nominal rate minus the current inflation rate. If inflation is 3%, your real return on that 5% bond is only 2%. This is a critical measure of the true cost of borrowing or the true return on saving.

6. How do interest rates affect my cryptocurrency investments?

Cryptocurrencies, particularly Bitcoin, have shown an increasing (though volatile) correlation with tech stocks. As high-risk, long-duration, and non-yielding assets, they are vulnerable to rising rates for the same reasons as growth stocks. The “risk-off” environment fostered by higher rates typically leads to capital flowing out of speculative assets like crypto.

7. What is an “inverted yield curve” and why is it a feared recession signal?

A yield curve plots the interest rates of bonds with equal credit quality but different maturities. Normally, it slopes upward (long-term rates are higher than short-term). An inversion occurs when short-term rates are higher than long-term rates. This is seen as a powerful recession predictor because it implies investors believe the Fed’s current high-rate policy will ultimately slow the economy so much that it will be forced to cut rates in the future.

8. When will the Fed start cutting rates again?

There is no definitive answer, as the Fed is data-dependent. However, investors should watch key indicators like the Consumer Price Index (CPI) and the Employment Situation Report. The Fed will likely start signaling cuts only when it is confident that inflation is sustainably returning to its 2% target.

9. Should I try to time the market based on interest rate predictions?

Market timing is a notoriously difficult and often futile strategy. Instead of trying to predict the Fed’s every move, focus on building a diversified, resilient portfolio aligned with your long-term financial goals and risk tolerance. A well-structured portfolio can weather different interest rate environments.

10. What is Quantitative Tightening (QT) and how is it different from rate hikes?

While rate hikes make borrowing more expensive, QT is the process of the Fed reducing its massive balance sheet by letting bonds mature without reinvesting the proceeds. It’s a subtler form of monetary tightening that removes liquidity from the system and puts upward pressure on long-term rates.

Actionable Strategies for the Modern Investor

Navigating interest rate cycles doesn’t require a crystal ball, but it does require a plan.

- Diversification is Your Best Defense: A portfolio spread across asset classes (stocks, bonds, real estate, cash) will react differently to rate changes, smoothing out your returns.

- Know Your Duration: Understand the interest rate sensitivity of your investments. If you own bonds, consider the duration. If you own stocks, know if they are value or growth-oriented.

- Stay Liquid: In a high-rate environment, cash is no longer trash. High-yield savings accounts and money market funds can offer attractive returns with zero risk to your principal.

- Focus on the Long Term: Emotional, short-term reactions to Fed announcements are a recipe for poor returns. Stick to your investment plan. History shows that while rate cycles cause volatility, markets have consistently trended upward over the long run for those who stay invested.

Conclusion: Mastering the Tide, Not Fighting the Current

Interest rates are the most powerful fundamental force in the financial universe. They are not an abstract concept but a dynamic variable that directly impacts the value of your home, the growth of your retirement fund, and the stability of the global economy. By understanding the core mechanics—the time value of money, the risk-return tradeoff, and the sectoral rotations—you transform from a passive observer into an empowered participant.

The goal is not to outsmart the Fed but to comprehend its language and its tools. By building a resilient, informed strategy, you can position your portfolio to not just survive the fluctuations caused by changing interest rates, but to thrive through them. In the endless dance between capital and return, knowledge of interest rates is your most valuable partner.