Umbrella insurance is a supplemental liability policy that extends beyond the limits of your primary insurance, like homeowners or auto coverage. It provides an additional layer of protection against significant claims and lawsuits, safeguarding your assets, future earnings, and estate. This article explores the importance of umbrella insurance in estate planning, its benefits, practical examples, and considerations to help you determine if it’s right for you.

Why Umbrella Insurance Matters in Estate Planning

Estate planning is often associated with wills, trusts, and asset distribution. However, protecting your wealth from unforeseen events is equally important. In a society where lawsuits are increasingly common, a single accident could wipe out years of savings.

Umbrella insurance provides a financial safety net for individuals and families, extending coverage beyond your standard policies to protect your assets, estate, and future earnings. It acts as an invisible shield, giving peace of mind and ensuring your hard-earned assets are safeguarded for generations.

What Is Umbrella Insurance?

Umbrella insurance is a personal liability insurance policy that provides coverage above and beyond your primary insurance, such as:

- Auto insurance

- Homeowners insurance

- Renters insurance

It is designed to cover large claims or lawsuits that might exceed your basic insurance limits. For example, if you’re liable in a major car accident, your auto insurance may only cover up to $300,000. An umbrella policy can cover additional costs beyond this limit, often up to $1 million or more.

Key Features of Umbrella Insurance:

- Excess Liability Coverage: Provides additional coverage above your primary policies.

- Broader Protection: Covers situations standard policies do not, including: libel, slander, defamation, false arrest, and more.

- Worldwide Protection: Offers coverage both domestically and internationally.

- Affordable Premiums: On average, $150–$300 per year for $1 million in coverage (Investopedia).

Why Umbrella Insurance Is Crucial for Estate Planning

Integrating umbrella insurance into estate planning is about asset protection. It ensures that your wealth, accumulated over years, is preserved and passed on without financial strain due to lawsuits or liabilities.

Major Benefits Include:

- Asset Protection: Safeguards savings, investments, property, and future earnings.

- Legal Defense Coverage: Covers attorney fees, court costs, and settlements.

- Peace of Mind: Provides financial security in an unpredictable world.

Real-life Insight: According to the Insurance Information Institute (III), personal liability claims exceeding $500,000 are becoming more frequent, emphasizing the need for extra protection.

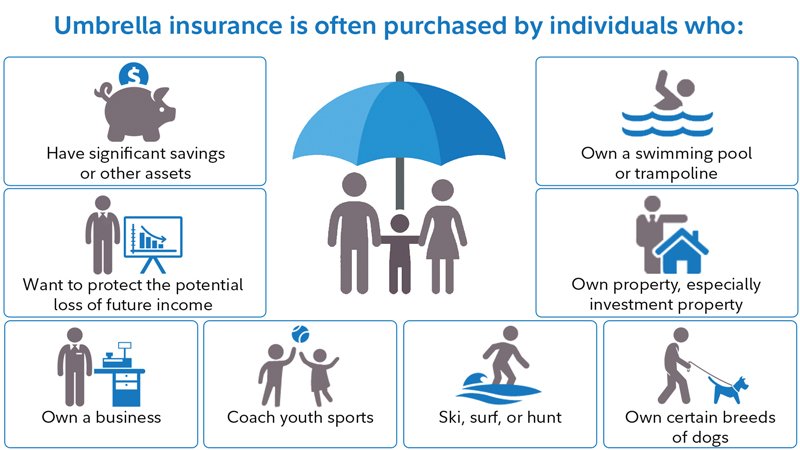

Who Should Consider Umbrella Insurance?

While anyone can benefit, umbrella insurance is particularly valuable for individuals with:

- High net worth: Protects substantial assets from potential lawsuits.

- Homeowners with pools or trampolines: Higher risk of accidents.

- Parents of teenage drivers: Teens are statistically more likely to be involved in accidents.

- Landlords: Rental properties increase liability exposure.

- Frequent travelers: Provides protection for incidents abroad.

Even middle-income families with savings or real estate can benefit. The cost is relatively low compared to the risk of large lawsuits.

Real-Life Scenarios: When Umbrella Insurance Saves the Day

Scenario 1: Car Accident Liability

Imagine you’re at fault in a car accident causing $500,000 in damages. Your auto insurance covers $300,000. Without umbrella insurance, you’d pay the remaining $200,000 from your assets. An umbrella policy covers this excess, protecting your estate from major financial loss.

Scenario 2: Injury on Rental Property

A guest at your rental property slips and falls, incurring medical expenses of $400,000. Homeowners insurance covers $300,000. The remaining $100,000 could be devastating. Umbrella insurance covers this excess, saving your finances and preventing lawsuits from draining your wealth.

Scenario 3: Social Media Defamation

Suppose a casual social media post is misinterpreted and leads to a defamation lawsuit. Standard insurance likely won’t cover this. Umbrella policies often cover libel, slander, and false arrest, demonstrating their importance in today’s digital age.

How Much Umbrella Insurance Do You Need?

Calculating the right amount of coverage is crucial. Experts recommend assessing:

- Net Worth: Sum up assets, including savings, investments, and property.

- Primary Insurance Coverage: Identify gaps in liability limits.

- Potential Risks: Include lifestyle, family circumstances, and property risk factors.

- Future Earnings: Consider how lawsuits could impact future income.

Rule of Thumb: Many financial advisors suggest umbrella coverage equal to your net worth (NerdWallet).

Common Misconceptions About Umbrella Insurance

Myth 1: Only the Wealthy Need It

Even middle-income earners with assets, cars, or rental properties can benefit. Umbrella insurance is affordable relative to the protection it offers.

Myth 2: It Covers Everything

Umbrella insurance doesn’t cover business liabilities, intentional acts, or damage to your own property. Understanding exclusions is key to making informed decisions.

How to Obtain Umbrella Insurance

- Review Existing Policies: Ensure primary policies meet insurer requirements.

- Contact Your Insurer: Ask about adding an umbrella policy.

- Shop Around: Compare quotes from multiple insurers.

- Consult a Financial Advisor: Determine appropriate coverage for your estate and risk profile.

Tip: Most insurers require minimum underlying coverage (e.g., $300,000–$500,000 for auto and homeowners) before offering an umbrella policy.

Frequently Asked Questions (FAQs)

1. What exactly is umbrella insurance and how does it work?

Umbrella insurance is a type of extra liability coverage that goes beyond the limits of your primary insurance policies, such as homeowners, auto, or renters insurance. It acts as a financial “umbrella” protecting your assets if you face a lawsuit or major claim. For example, if you’re involved in a car accident and the damages exceed your auto insurance coverage, the umbrella policy covers the excess amount. Unlike standard insurance, it often covers broader incidents, including defamation, slander, or libel, that primary policies might exclude. Essentially, it’s a safety net that ensures one large claim doesn’t drain your savings or impact your estate planning goals.

2. Who needs umbrella insurance, and is it only for wealthy people?

While high-net-worth individuals often prioritize umbrella insurance, it’s not exclusive to the wealthy. Middle-income families with assets such as homes, savings, or investment accounts can benefit significantly. Even having a pool, trampoline, teenage drivers, or rental properties increases liability exposure. The cost is relatively low—$150–$300 per year for $1 million in coverage—making it accessible for most families. Essentially, anyone who wants to protect their assets and future income from unexpected lawsuits should consider an umbrella policy.

3. How does umbrella insurance complement estate planning?

Estate planning isn’t just about distributing wealth; it’s about protecting your legacy from financial risks. Umbrella insurance provides an additional layer of protection for assets that you plan to pass on to heirs. For instance, if a lawsuit arises and your primary insurance is insufficient, the umbrella policy ensures that savings, investments, or trusts are not depleted. It prevents potential creditors or claimants from seizing your estate, keeping your long-term financial plan intact. This makes it a critical tool in comprehensive estate planning.

4. What types of incidents or claims does umbrella insurance cover?

Umbrella insurance covers a wide range of liability scenarios that can exceed primary policy limits, including:

- Severe car accident damages exceeding auto insurance limits

- Medical bills from injuries on your property

- Libel, slander, or defamation lawsuits

- False arrest or malicious prosecution claims

- Certain personal liability claims that occur outside the United States

It’s important to note that intentional acts, business-related liabilities, and property damage to your own assets are not covered. Understanding these exclusions ensures you have realistic expectations and additional insurance if necessary.

5. How much umbrella insurance coverage should I get?

Coverage depends on net worth, lifestyle, and risk factors. A typical starting point is $1 million, but many financial planners recommend coverage that matches or exceeds your total net worth. For example, if you have $2 million in assets, a $2 million umbrella policy would be prudent. Consider factors like:

- Homeowners insurance limits

- Number of vehicles and drivers in the household

- Rental properties or other high-risk assets

- Potential future earnings and estate growth

The goal is to ensure that no lawsuit could jeopardize your estate or personal finances.

6. Does umbrella insurance cover legal fees?

Yes. One of the most valuable aspects of umbrella insurance is that it covers legal defense costs, including attorney fees, court costs, and settlements. Even if a claim is frivolous, defending yourself in court can be expensive. Without umbrella coverage, these costs come directly from your assets, potentially impacting your estate planning goals. By including legal defense coverage, an umbrella policy provides financial security and peace of mind.

7. Can I get umbrella insurance if my primary policies are with a different insurer?

In many cases, yes. While some insurance companies require that your primary policies be bundled with them, many insurers allow separate umbrella policies. However, they typically require minimum underlying coverage amounts (e.g., $300,000–$500,000 for auto and homeowners insurance). It’s wise to shop around and compare quotes to find the best coverage, ensuring that your umbrella policy aligns with your overall estate planning strategy.

8. Does umbrella insurance cover incidents abroad?

Most umbrella insurance policies provide worldwide coverage, meaning you’re protected from incidents that occur outside the United States. For example, if you accidentally injure someone while traveling internationally, your umbrella policy may cover legal fees, medical claims, and settlements. This global protection is especially valuable for frequent travelers, expatriates, or families with children studying abroad. Always check the policy’s terms to confirm international coverage limits and exclusions.

9. Is umbrella insurance necessary if I have a trust or other estate planning tools?

Yes. A trust or will helps distribute assets according to your wishes, but it doesn’t prevent lawsuits from threatening your wealth. Umbrella insurance complements trusts by covering liability claims that could otherwise deplete the trust’s assets. For instance, if a legal claim arises and your primary insurance falls short, the umbrella policy ensures the trust remains intact for beneficiaries. Combining trusts with umbrella insurance provides a dual layer of protection, making your estate plan more robust.

10. How often should I review or update my umbrella insurance coverage?

Life circumstances change, and so do risks. It’s recommended to review umbrella coverage annually, or after major events such as:

- Buying a new home or property

- Adding a new vehicle or teenage driver

- Significant increases in savings or investments

- Marriage, divorce, or birth of a child

- Starting a business or engaging in high-risk activities

Regularly reviewing ensures that your coverage remains sufficient to protect your evolving assets and aligns with your estate planning goals.

Umbrella Insurance in Numbers

- Average cost: $150–$300/year for $1 million coverage.

- Typical liability coverage of primary auto/home policies: $300,000–$500,000.

- Percentage of Americans with umbrella insurance: Approximately 10% .

- Average liability claim exceeding primary policy limits: $500,000+.

These figures show why even moderate earners should consider umbrella insurance to prevent catastrophic financial loss.

Practical Takeaways

- Umbrella insurance is a cost-effective way to protect assets beyond standard insurance limits.

- Real-life examples show how lawsuits can wipe out savings without adequate coverage.

- Coverage is flexible, typically starting at $1 million and increasing in $1 million increments.

- Adding umbrella insurance to estate planning ensures long-term financial security for family and heirs.

- It covers legal defense costs, often including cases unrelated to property or auto incidents.

Final Thoughts

Umbrella insurance is more than an optional policy—it’s an essential component of estate planning. By protecting your assets, providing legal defense coverage, and offering peace of mind, it ensures your wealth remains intact for future generations.

Incorporate umbrella insurance today to safeguard your legacy, and avoid the financial pitfalls that can arise from accidents, lawsuits, or unexpected liabilities.