Discover how AI is revolutionizing trading strategy in 2025 — from predictive analytics and reinforcement learning to sentiment-driven bots. Learn the top 7 transformations, real-life examples, pros & cons, and future trends in AI-powered trading.

AI is transforming global trading strategies with unmatched speed, accuracy, and adaptability. From deep learning models predicting price movements to reinforcement learning agents executing dynamic trades, artificial intelligence is redefining what “smart trading” means in 2025. This comprehensive guide explains how AI is reshaping trading strategy — with real-world examples, FAQs, and actionable insights to help traders thrive in the AI era.

Welcome to the AI-Powered Trading Revolution

In 2025, the fusion of artificial intelligence (AI) and financial trading has moved far beyond automation. AI now learns, adapts, and optimizes—often outperforming human intuition.

Machine learning, neural networks, and natural language processing (NLP) are transforming every layer of finance: prediction, execution, portfolio management, and risk control.

According to Grand View Research, the AI trading platform market is projected to soar from $11.23 billion in 2024 to $33.45 billion by 2030, growing at a 20% CAGR. Meanwhile, Stanford University reported that an AI “analyst” outperformed 93% of human fund managers over 30 years — with nearly 6x higher returns.

That’s not just evolution. It’s revolution.

This article explores:

How AI is changing trading strategies in real time

Real-world use cases & results from hedge funds and traders

Pros, cons, and implementation steps

Answers to trending FAQs Americans are asking about AI in trading

Rank Math & SEO publishing tips for WordPress

Let’s explore how AI is transforming every trading desk — from Wall Street to Main Street.

What Does “AI in Trading Strategy” Actually Mean?

Before diving deeper, let’s clear up the terminology often confused in finance:

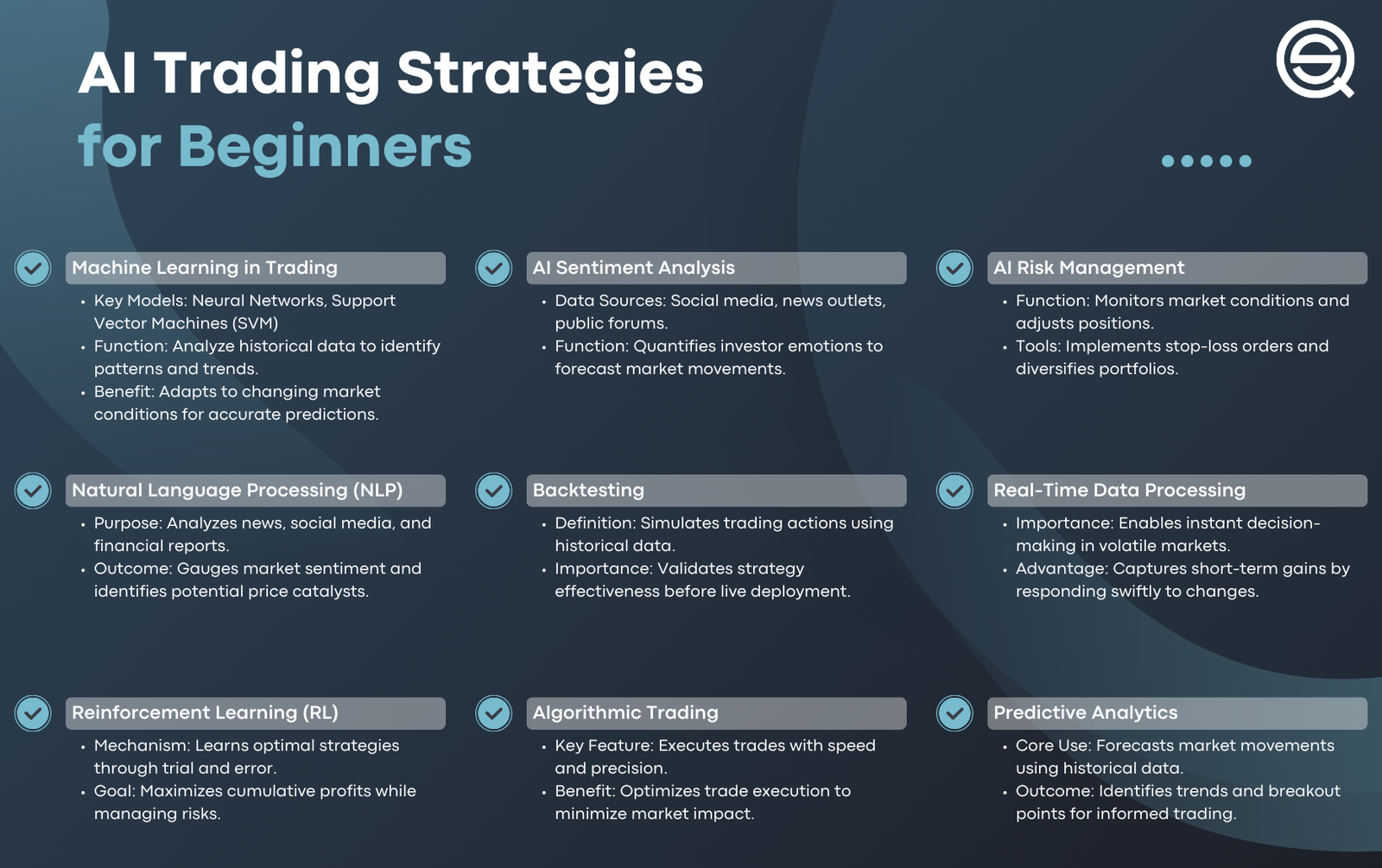

- Algorithmic Trading: Uses fixed rules (e.g., “Buy if RSI < 30”). No learning capability.

- Machine Learning Trading: Uses statistical learning to improve with more data.

- Deep Learning: Employs neural networks (LSTM, CNN, Transformer models) to uncover nonlinear relationships in data.

- Reinforcement Learning: AI learns optimal trading policies by trial and error, adapting to new environments dynamically.

- Hybrid AI Systems: Combine predictive models, NLP sentiment engines, and rule-based logic for real-time decisions.

In short: AI trading is not just rule-following. It’s self-improving, data-driven decision-making at machine speed.

7 Powerful Ways AI Is Reshaping Trading Strategy

1. Predictive Analytics & Pattern Recognition

AI analyzes billions of data points—from price, volume, and volatility to social sentiment and global macro news—to predict short-term and long-term price behavior.

Unlike traditional statistical models, AI can detect nonlinear dependencies that humans can’t see.

Example:

A hedge fund might use an LSTM (Long Short-Term Memory) neural network to forecast hourly volatility in NASDAQ futures. The model continuously retrains on live data, adjusting forecasts as liquidity or volume conditions shift.

AI can even identify micro-patterns such as:

- Volume spikes before institutional entries

- RSI divergence patterns indicating exhaustion

- Inter-market correlations between FX and equities

According to Quantified Strategies, predictive analytics allows AI models to “identify subtle market trends and forecast future price movements with higher accuracy than manual models.”

2. Sentiment Analysis & Natural Language Processing (NLP)

Markets don’t just move on data — they move on emotion.

AI now digests unstructured text from news, social media, earnings transcripts, and Reddit chatter, converting human sentiment into quantifiable trading signals.

Example:

During Tesla’s Q4 earnings call, an AI model may detect an unusually high ratio of positive sentiment terms from analysts (“record margins,” “delivery growth”). The model cross-references this with real-time stock price data, signaling a high-probability upward move.

Top NLP models like FinBERT or GPT-based sentiment extractors generate “sentiment delta” scores, directly integrated into algorithmic trading engines.

A 2025 report from Pure Financial Academy found that sentiment-driven AI models achieved up to 18% better returns than price-only systems.

3. Reinforcement Learning & Adaptive AI Agents

Reinforcement Learning (RL) represents the most intelligent layer of AI trading.

Instead of being “told” what to do, RL agents learn from experience. They take actions (buy/sell), receive rewards or penalties, and gradually learn the optimal policy.

Example:

An RL-based trading bot might start trading EUR/USD. After thousands of simulated trades, it learns that:

- Over-trading increases losses

- Volatility regimes alter risk-reward dynamics

- Momentum trades perform better in low-news hours

By continuously interacting with real market data, the AI refines its strategy far beyond static models.

A 2024 ScienceDirect study noted that RL and deep learning are now the fastest-growing areas in financial AI research, particularly in hedge fund applications.

4. Portfolio Optimization & Dynamic Asset Allocation

AI doesn’t just pick stocks—it dynamically balances portfolios based on real-time macro indicators.

Example:

A global equity fund uses AI to rebalance assets across U.S., Europe, and Asia-Pacific when inflation, rate hikes, or currency shifts are detected.

The AI model monitors:

- Interest rate updates

- Commodity correlations

- Global volatility indices

Within seconds, the system reallocates exposure—reducing risk and improving diversification.

Deloitte’s 2025 Investment Management Tech Trends report predicts that multi-agent AI systems will dominate asset allocation within the next three years, enabling funds to respond to economic shifts instantly.

5. Execution Optimization & Smart Order Routing

Even the smartest strategy fails if execution is poor. That’s why AI is also reshaping how orders are placed.

AI-driven execution systems decide where, when, and how much to trade—minimizing slippage, latency, and transaction costs.

Example:

The Norwegian Sovereign Wealth Fund (the world’s largest) announced in 2025 it expects to save $400 million annually using AI to internalize trades and optimize order routing (source: Financial Times).

By analyzing liquidity depth, AI can break large orders into small fragments, execute across multiple exchanges, and predict the least disruptive timing window.

For high-frequency traders, such millisecond-level optimization is a game-changer.

6. Risk Management & Anomaly Detection

Risk management is where AI truly shines.

AI models monitor portfolios in real time, flagging abnormal market conditions before human analysts can react.

Example:

When correlations between traditionally uncorrelated assets (e.g., gold and tech stocks) start to converge, the AI flags a “correlation anomaly.” The system can automatically hedge or de-risk the portfolio.

Some hedge funds employ adversarial AI, simulating “black swan” scenarios to test resilience.

The Bank of England recently warned that autonomous AI trading could amplify market instability—prompting regulators to consider AI-specific controls in algorithmic trading systems.

7. AI in Crypto & Retail Trading

AI isn’t confined to Wall Street. Retail traders and crypto investors are adopting AI bots that replicate institutional performance.

Platforms like 3Commas, Tickeron, and AlgosOne report that AI-driven bots achieve 60–80% trade accuracy under optimized conditions.

- 3Commas’s DCA bots generated 12–15% annual returns in 2024 on select pairs.

- Tickeron reported 75% accuracy on momentum AI agents in early 2025.

- AlgosOne showed that consistent retraining and data feed quality significantly improved live vs. backtest performance.

For retail traders, AI levels the playing field by making institutional-grade tools accessible via simple dashboards and APIs.

Advantages vs. Pitfalls of AI-Driven Trading

Advantages

- Speed: Processes millions of data points in milliseconds.

- Objectivity: Eliminates emotional biases.

- Continuous Learning: Self-improves via reinforcement feedback.

- Cost Efficiency: Reduces slippage, trading costs, and execution errors.

- Scalability: Handles multi-asset portfolios simultaneously.

Pitfalls & Risks

- Overfitting: Models that perform well in backtests but fail live.

- Data Bias: Garbage-in-garbage-out problem.

- Lack of Transparency: Deep learning “black boxes” defy human explanation.

- Regime Shifts: Models trained on bull markets might fail in bear cycles.

- Systemic Risk: Similar AI models used by multiple institutions can cause flash crashes.

- Ethical & Regulatory Risks: Unchecked AI could engage in manipulative trading or spoofing.

The Bank of England and IMF have already issued warnings about potential “AI-driven cascades” — emphasizing the need for stronger human oversight.

How to Build or Adopt an AI-Based Trading Strategy

Even if you’re a retail or small institutional trader, you can start implementing AI-driven systems today.

Here’s a simplified roadmap

Step 1: Define Your Trading Universe

Decide your focus (e.g., equities, crypto, forex) and hypothesis.

Example: “Sentiment changes in Twitter mentions of a stock precede short-term price movements.”

Step 2: Collect & Clean Data

Gather datasets from:

- Historical prices

- Order books

- News sentiment

- Macroeconomic indicators

Clean the data, align timestamps, remove duplicates, and normalize values.

Step 3: Choose Model Type

Depending on your goal:

- LSTM / GRU: For time-series forecasting

- CNN: For price pattern recognition

- Transformer: For multi-modal data

- Reinforcement Learning: For policy optimization

Step 4: Feature Engineering

Combine raw and derived features like moving averages, RSI, and sentiment deltas.

Step 5: Backtest with Realistic Conditions

Simulate trades with transaction costs, slippage, and latency included. Use walk-forward validation to mimic real conditions.

Step 6: Risk Management

Use volatility-based position sizing, stop-losses, and diversification.

Step 7: Deploy on Live Systems

Start small. Monitor daily performance metrics like Sharpe ratio, drawdowns, and hit rates.

Step 8: Retrain Periodically

Retrain models monthly or quarterly to prevent “data drift.”

Step 9: Maintain Explainability & Logs

Keep decision logs, trade triggers, and explanations for compliance and audits.

Step 10: Integrate Human Oversight

Even the best AI needs a human safety net. Maintain manual override and kill-switch mechanisms.

FAQs About AI Trading in 2025

Q1. Can AI really beat the market consistently?

Yes — AI models can outperform traditional fund managers when updated frequently and managed with discipline. For instance, a Stanford University study showed an AI analyst beat 93% of human fund managers over 30 years. However, consistent success depends on data quality, risk management, and retraining frequency.

Q2. How does AI use news and social media in trading?

AI uses NLP to scan millions of text sources (news, Reddit, Twitter). It calculates sentiment polarity and trend acceleration, turning emotion into actionable trading signals.

Q3. What’s the typical success rate of AI trading bots?

Performance varies. Leading platforms like Tickeron and AlgosOne report 60–80% accuracy, but risk-adjusted returns depend on market volatility and execution quality.

Q4. Is AI trading only for big institutions?

No. Cloud tools like 3Commas and Alpaca API make AI trading accessible to individuals. The challenge is discipline, not capital.

Q5. How much money do I need to start AI trading?

You can start with $5,000–$10,000 in low-cost markets. The real investment is in building or renting AI models and ensuring risk controls.

Q6. How do regulators view AI-based trading?

Regulators require AI models to be explainable and transparent. Agencies like the SEC and Bank of England are developing frameworks to govern AI-driven systems and prevent flash-crash scenarios.

Q7. How often should AI trading models be retrained?

Every month to quarter, depending on market regime changes. For high-frequency systems, retraining might be daily.

Q8. How do traders prevent AI overfitting?

By using walk-forward testing, regularization, feature selection, and ensemble averaging. Monitoring live vs. backtest divergence is crucial.

Q9. What infrastructure do AI trading systems need?

Essential components include:

- Cloud GPUs or TPUs

- Data pipelines (ETL)

- ML frameworks like TensorFlow or PyTorch

- Broker APIs (e.g., Interactive Brokers)

- Monitoring dashboards

Q10. What’s the future of AI trading?

Expect multi-agent AI systems, explainable AI (XAI), and meta-AI monitoring tools that oversee other AI agents to ensure compliance, accuracy, and ethics.

Final Thoughts: The Human + Machine Future of Trading

Artificial intelligence is no longer an experimental tool in trading — it’s becoming the backbone of market strategy.

From hedge funds to retail platforms, AI is reshaping how we think, act, and profit in markets. Yet, while algorithms can learn patterns, human oversight remains essential for ethics, transparency, and judgment.

The traders who combine AI precision with human intuition will define the next era of finance.