Executive Summary

The American healthcare system stands at a pivotal inflection point. Burdened by unsustainable costs, fragmented delivery, and outdated models, it is simultaneously being reshaped by a convergence of powerful, disruptive forces. This analysis examines the three trends most likely to define the future of US healthcare: the maturation of telemedicine, the rise of data-driven personalized medicine, and the unstoppable march toward price transparency. Individually, each represents a significant shift; collectively, they are forging a new paradigm that is more digital, proactive, personalized, and consumer-centric. This report delves into the market drivers, current adoption, regulatory landscape, and future trajectory of each trend. It argues that the ultimate transformation of the US healthcare system hinges on the successful integration of these elements, moving from a reactive, fee-for-service “sick care” model to a value-based, preventative, and patient-empowered ecosystem. The organizations that thrive will be those that embrace this convergence, leveraging technology and transparency to deliver superior outcomes at a sustainable cost.

1. Introduction: The Imperative for Change

The US healthcare system, accounting for nearly 20% of the nation’s GDP, is a paradox of world-class innovation and profound systemic dysfunction. It is characterized by the highest per-capita spending among developed nations, yet it often delivers uneven quality, poor accessibility, and frustrating patient experiences. The traditional, hospital-centric, fee-for-service model is increasingly recognized as financially untenable and misaligned with patient needs.

The pressures for change—soaring costs, consumer demand for convenience, and technological advancement—have been building for years. The COVID-19 pandemic acted as a catalytic accelerant, forcing a rapid adoption of new technologies and exposing deep-seated inefficiencies. Out of this crisis, a new blueprint for American healthcare is emerging, built upon three foundational pillars:

- Telemedicine: Changing where and how care is delivered.

- Personalized Medicine: Changing what care is delivered.

- Cost Transparency: Changing how care is valued and paid for.

This report provides a detailed market analysis of these three transformative trends, exploring their individual dynamics and, more importantly, their powerful synergy in creating a more resilient, efficient, and effective healthcare system for the future.

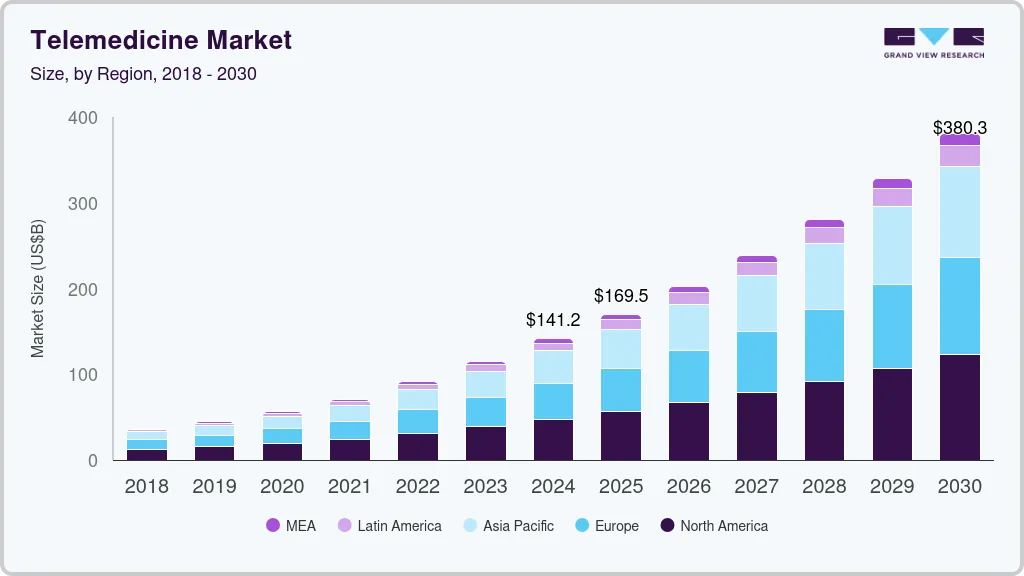

2. The Telemedicine Revolution: From Pandemic Stopgap to Care Delivery Cornerstone

Telemedicine, the remote delivery of healthcare services using telecommunications technology, has evolved from a niche service to a mainstream care modality.

2.1 The Pandemic Catalyst and Lasting Adoption

Prior to 2020, telemedicine adoption was hampered by regulatory hurdles, reimbursement limitations, and technological skepticism. The Public Health Emergency (PHE) changed everything overnight:

- Regulatory Flexibilities: The Centers for Medicare & Medicaid Services (CMS) expanded reimbursement for telehealth services, waived geographic restrictions, and allowed the use of everyday communication platforms like FaceTime and Zoom for patient visits.

- Consumer and Provider Acceptance: Forced to use telehealth, both patients and providers discovered its benefits. Utilization skyrocketed, with some health systems reporting a 50- to 175-fold increase in telehealth visits.

Post-pandemic, utilization has settled from its peak but has stabilized at a level 38 times higher than pre-pandemic levels, according to a McKinsey analysis, demonstrating its permanent role in the care continuum.

2.2 The Evolving Telemedicine Market: Beyond the Video Visit

The telemedicine market has matured beyond simple video consultations into a sophisticated ecosystem:

- Asynchronous Telehealth (Store-and-Forward): Patients answer questions and submit images (e.g., of a skin condition) through a platform, and a provider reviews them and provides a treatment plan within hours. This maximizes efficiency for both parties.

- Remote Patient Monitoring (RPM): Using connected devices (blood pressure cuffs, glucose meters, pulse oximeters), providers can continuously track patients’ health data from their homes. This is transformative for managing chronic conditions like diabetes, hypertension, and congestive heart failure, enabling early intervention and preventing costly hospitalizations.

- Hybrid Care Models: The future is not purely virtual or purely in-person. The winning model is hybrid, where the patient’s journey is seamlessly navigated between digital and physical touchpoints based on clinical appropriateness and patient preference. A routine follow-up might be virtual, while a necessary physical exam is in-person.

2.3 Market Drivers and Growth Areas

- Consumer Demand for Convenience: Patients, especially younger generations, demand the same convenience from healthcare that they get from other industries. Avoiding travel, waiting rooms, and time off work is a powerful value proposition.

- Specialty Expansion: While behavioral health and primary care led the initial wave, telemedicine is now expanding into specialties like dermatology, neurology (telestroke), and chronic disease management.

- Provider and Payer Integration: Health systems are building their own virtual care platforms to retain patients, and payers are expanding coverage for telehealth services, recognizing their potential to reduce downstream costs.

2.4 Challenges and the Path Forward

- The Digital Divide: Ensuring equitable access for elderly, low-income, and rural populations who may lack broadband or digital literacy remains a critical challenge.

- Regulatory Uncertainty: The permanence of temporary pandemic-era waivers is a key question. The healthcare industry requires regulatory clarity to make long-term investments in virtual care infrastructure.

- Clinical Limitations: Not all conditions can be treated virtually. Defining the appropriate scope for telehealth is essential for maintaining quality and safety.

- Provider Workflow Integration: Telehealth must be seamlessly integrated into Electronic Health Records (EHRs) and clinical workflows to avoid creating additional burden for providers.

3. The Rise of Personalized Medicine: From One-Size-Fits-All to N-of-1

Personalized medicine (also known as precision medicine) is a revolutionary approach that tailers medical treatment to the individual characteristics, needs, and genetics of each patient.

3.1 The Foundation: Genomics and Biomarkers

The completion of the Human Genome Project was the starting pistol. Today, the plunging cost of genetic sequencing (from billions of dollars to a few hundred) has made it accessible.

- Pharmacogenomics: Testing how a patient’s genes affect their response to drugs. This allows doctors to prescribe the right drug at the right dose from the start, avoiding adverse drug reactions and ineffective treatments.

- Diagnostic Biomarkers: Identifying specific genetic mutations or protein signatures that can detect diseases like cancer much earlier or with greater accuracy.

- Targeted Therapies: Developing drugs that target specific molecular pathways involved in a disease, most prominently in oncology. Drugs like Herceptin for HER2-positive breast cancer are iconic examples.

3.2 The Tools of Personalization

The ecosystem extends far beyond genomics:

- Liquid Biopsies: A simple blood test that can detect cancer DNA, used for early detection, monitoring treatment response, and identifying resistance mutations—all less invasively than a tissue biopsy.

- Multi-Omics: Integrating data from genomics (DNA), transcriptomics (RNA), proteomics (proteins), and metabolomics (metabolites) to create a comprehensive picture of an individual’s health and disease state.

- AI and Big Data Analytics: The vast datasets generated by personalized medicine require sophisticated algorithms to find patterns, predict disease risk, and identify new therapeutic targets.

3.3 Market Applications and Impact

- Oncology: The undeniable leader in personalized medicine. Tumor sequencing is now standard of care for many cancers, guiding treatment decisions and enabling access to clinical trials for specific mutations.

- Rare Diseases: Genomic sequencing can end the “diagnostic odyssey” for patients with rare genetic conditions, providing answers and, in some cases, guiding treatment.

- Preventive Health and Wellness: Direct-to-Consumer (DTC) genetic testing companies like 23andMe and Ancestry.com have popularized genetics. While their health reports are limited, they represent a growing consumer interest in proactive, personalized health information.

3.4 Challenges to Widespread Adoption

- High Upfront Costs: Targeted therapies and genetic tests can be expensive, creating challenges for payer reimbursement and raising concerns about health equity.

- Data Interpretation and Clinical Utility: Having the genetic data is one thing; knowing how to interpret it and apply it to patient care is another. The healthcare workforce needs more training in genomics.

- Data Privacy and Security: Genomic data is the ultimate personally identifiable information. Robust frameworks are needed to protect this sensitive data from misuse.

- Regulatory Hurdles: The FDA is continuously adapting its approval processes for drugs and diagnostics that are tied to specific biomarkers, navigating a new and complex landscape.

4. The Drive for Cost Transparency: Shining a Light on the Black Box

For decades, healthcare prices in the US have been largely opaque, making it nearly impossible for consumers to shop for care and for employers to manage costs. A regulatory and market-driven push for transparency is finally forcing a reckoning.

4.1 The Regulatory Hammer: The Transparency in Coverage Rules

A landmark set of federal rules has fundamentally changed the game:

- Hospital Price Transparency Rule (effective Jan 1, 2021): Requires hospitals to publicly post standard charges for all items and services, including gross charges, payer-negotiated rates, and cash-discounted prices.

- Transparency in Coverage Rule (phased in 2022-2024): Requires health plans and insurers to provide personalized out-of-pocket cost information for 500+ “shoppable” services via an online tool and to publicly post their in-network negotiated rates and historical out-of-network allowed amounts.

4.2 The Market Response and Emerging Tools

While compliance has been uneven, the genie is out of the bottle. The market is responding with new tools and models:

- Price Comparison Tools: Health plans, third-party companies (like Turquoise Health), and hospitals themselves are developing tools that allow patients to compare costs for procedures like MRIs or elective surgeries.

- Reference-Based Pricing (RBP): Employers set a maximum contribution they will pay for a specific service (e.g., a knee MRI), based on a percentage of Medicare rates. Employees are then responsible for costs above that reference price, incentivizing them to seek lower-cost providers.

- High-Deductible Health Plans (HDHPs): The growth of HDHPs, which shift more initial costs to consumers, has created a natural demand for price information.

4.3 The Impact on the Healthcare Ecosystem

- Empowering Consumers: For the first time, patients have the potential to make informed financial decisions about their care, much like they do for any other major purchase.

- Driving Competition: Transparency puts pressure on high-cost, low-value providers to justify their prices or risk losing market share. It empowers employers and payers to contract with more efficient providers.

- Exposing Price Variation: The published data has revealed staggering, often irrational, price variation for the same service within the same geographic area, strengthening the case for reform.

Read more: The US Labor Market Under a Microscope: Analyzing Remote Work’s Lasting Impact and the Skills Gap

4.4 The Long Road to True Transparency

Significant barriers remain:

- Complexity and Data Usability: The data files released by hospitals and insurers are massive, complex, and difficult for the average consumer to navigate and understand.

- Enforcement and Compliance: Ensuring all hospitals and health plans are fully compliant with the rules is an ongoing challenge for regulators.

- Bundled Services: The cost of a surgery isn’t just the surgeon’s fee; it includes the facility, anesthesia, and implants. Getting a true, all-in price remains difficult.

- Cultural Shift: Changing the behavior of both providers (to compete on price and quality) and patients (to actively shop for care) will take years.

5. The Convergence: The Synergistic Future of US Healthcare

The true transformation of US healthcare will occur not from these trends operating in isolation, but from their powerful convergence. Imagine a future scenario:

A 45-year-old patient, John, uses his health plan’s cost transparency tool to find a high-quality, low-cost primary care provider for his annual physical. The visit is conducted via telemedicine. Based on his family history, his provider recommends a personalized medicine approach: a genetic test to assess his risk for cardiovascular disease and pharmacogenomic testing to guide any future medication decisions. The test results, integrated into his EHR, reveal a slightly elevated risk for statin-related myopathy. When John’s RPM device detects a sustained rise in his blood pressure, his care team is alerted. They contact him via a hybrid model—a virtual visit to discuss lifestyle changes and a precise, genetically appropriate medication prescription, the cost of which he already verified through his transparency tool. He avoids an adverse drug reaction and a potential future cardiac event.

This is a seamless, proactive, and efficient care journey powered by the integration of all three trends.

6. Conclusion: The Path to a Value-Based, Patient-Centric Future

The US healthcare system is undergoing a necessary and unstoppable metamorphosis. The forces of telemedicine, personalized medicine, and cost transparency are dismantling the old, inefficient paradigm and laying the groundwork for a new one.

This new system will be:

- Digital-First and Hybrid: Care will be accessible and convenient, blending virtual and in-person touchpoints optimally.

- Proactive and Predictive: Medicine will shift from treating sickness to maintaining wellness, using data to predict and prevent disease.

- Precise and Personal: Treatments will be tailored to the individual, maximizing efficacy and minimizing side effects.

- Transparent and Accountable: Prices and outcomes will be clear, driving competition based on value and empowering informed consumers.

The journey is fraught with challenges—regulatory, technological, and cultural. However, the direction is clear. The organizations that will lead the future of US healthcare are those that invest not in resisting this change, but in orchestrating the convergence of these transformative trends to deliver better health, better care, and lower costs for all.

Read more: Top 7 Revelations from the AI Investing Software Market Report 2025–2030 (Ultimate Guide)

FAQ Section

Q1: Is telemedicine as effective as in-person care?

For many use cases, yes. Extensive research has shown that for follow-up visits, medication management, chronic disease check-ins, and especially mental health services, telemedicine delivers outcomes equivalent to in-person care with high levels of patient and provider satisfaction. It is not suitable for all conditions (e.g., emergencies, complex physical exams), which is why a hybrid model is considered the ideal future state.

Q2: I’ve done a DTC genetic test (like 23andMe). Is that the same as the personalized medicine used by my doctor?

Not exactly. DTC tests provide valuable insights for ancestry and some health predispositions, but they are often not clinically diagnostic. The genomic testing ordered by your physician is typically more comprehensive, clinically validated, and interpreted by a genetic counselor or trained physician in the context of your personal and family medical history. Always discuss any DTC results with your healthcare provider.

Q3: The hospital price transparency data is confusing. How can I, as a patient, actually use it?

You’re right, the raw data is complex. Start by using the tools designed for consumers:

- Use your health insurance company’s online cost estimator tool. This is often the most accurate as it shows your negotiated rate and out-of-pocket cost.

- Use third-party websites and apps like Turquoise Health or Healthcare Bluebook, which aggregate the published data in a more user-friendly way.

- Call the provider’s billing department directly and ask for a “good faith estimate” for a scheduled service. Under new rules, they are required to provide this.

Start with “shoppable” services like imaging scans (MRIs, CT scans), lab tests, or elective procedures.

Q4: Won’t personalized medicine and all this genetic testing make healthcare even more expensive?

There is a compelling argument that it will ultimately reduce costs. While the initial tests and targeted therapies are expensive, they can save money by:

- Avoiding ineffective treatments and their associated side effects.

- Enabling earlier disease detection, when treatment is less invasive and less costly.

- Preventing hospitalizations through better management of chronic diseases.

The goal is to shift spending from wasteful, trial-and-error care to precise, high-value interventions.

Q5: What is the single biggest barrier to this futuristic vision of healthcare becoming a reality?

Interoperability—the seamless, secure, and efficient sharing of health data between different systems. Today, patient data is often siloed in different hospital EHRs, insurer databases, and patient-generated data from apps and devices. For telemedicine, personalized medicine, and cost transparency to work together synergistically, this data must flow freely and securely. Solving the interoperability challenge is the “plumbing” that makes the entire vision possible.

Disclaimer: This market analysis is based on current trends, regulatory frameworks, and technological developments as of 2024. The healthcare landscape is rapidly evolving, and policies, reimbursement models, and technologies are subject to change. This report is intended for informational and strategic purposes only and does not constitute medical, financial, or legal advice. Patients should always consult with qualified healthcare professionals for personal medical decisions.

Read more: Beyond Silicon Valley: An Analysis of Emerging Tech Hubs and Talent Pools Across the United States