Compound interest is the fundamental financial principle where you earn returns not only on your initial investment but also on the accumulated interest from previous periods. Often called the “Eighth Wonder of the World,” its power lies in exponential growth over time. This transformative force is the cornerstone of long-term wealth building, turning modest, consistent savings into substantial sums. The key variables are the amount invested, the rate of return, and, most critically, time. Understanding and leveraging compound interest is non-negotiable for anyone seeking financial independence, as it rewards patience, consistency, and a long-term perspective like no other strategy.

Introduction: The “Eighth Wonder of the World”

What if you possessed a simple, legal, and widely accessible tool that could systematically build wealth, even while you sleep? A force so powerful that Albert Einstein allegedly, if apocryphally, dubbed it the “eighth wonder of the world.” This is not a mythical secret or a complex scheme reserved for the financial elite. It is the undeniable, mathematical certainty of compound interest.

For many Americans, the path to financial security feels like an uphill battle against stagnant wages, rising costs, and market volatility. The pain of watching savings accounts yield minimal returns or the anxiety of not starting to save early enough is all too real. This article addresses these pain points directly. We will demystify compound interest, moving it from an abstract mathematical concept to your most trusted financial ally. We will explore, with relatable examples and actionable advice, how you can harness this power to build a secure and prosperous future, proving that it’s not about timing the market, but time in the market that truly counts.

What is Compound Interest? A Simple Definition

At its core, compound interest is the process of earning “interest on interest.” It’s the multiplier effect that causes wealth to grow at an accelerating rate, rather than a linear one.

- Simple Interest: You earn a return only on your original principal. If you invest $1,000 at 5% simple interest, you earn $50 every year. After 20 years, you have your $1,000 principal plus $1,000 in interest ($50 x 20 years), for a total of $2,000.

- Compound Interest: You earn a return on your principal and on the interest that has already been added. That same $1,000 at 5% annual compound interest would grow to $2,653.30 in 20 years—over $650 more, without you lifting a finger after the initial investment.

The distinction is profound. Simple interest adds; compound interest multiplies. This exponential growth is what makes it the engine of virtually every successful long-term investment strategy, from retirement accounts like 401(k)s and IRAs to broad-market index funds.

The Math Behind the Magic: The Compound Interest Formula

While you don’t need to be a mathematician to benefit from it, understanding the formula underscores its power. The standard compound interest formula is:

A = P (1 + r/n)^(nt)

Where:

- A = the future value of the investment/loan, including interest

- P = the principal investment amount (the initial deposit or loan amount)

- r = the annual interest rate (decimal)

- n = the number of times that interest is compounded per year

- t = the number of years the money is invested or borrowed for

Let’s bring this to life with a real-world scenario. Suppose Sarah, at age 25, invests $5,000 in a Roth IRA with an estimated average annual return of 7% (compounded annually). She never touches it again.

- After 40 years (at age 65), that single $5,000 investment would be worth:

- A = 5000 (1 + 0.07/1)^(1*40)

- A = 5000 (1.07)^40

- A = 5000 * 14.974

- A = $74,870

A single $5,000 investment grew nearly 15-fold. Now, imagine if Sarah contributed consistently. This leads us to the most critical ingredient of all.

The Most Critical Ingredient: Time

If there is one single takeaway from this article, it is this: Time is the most powerful component of the compound interest equation. The longer your money remains invested, the more dramatic the growth becomes. The latter years of growth dwarf the earlier ones because the “snowball” has accumulated so much mass.

A Tale of Two Investors: The Ultimate Proof

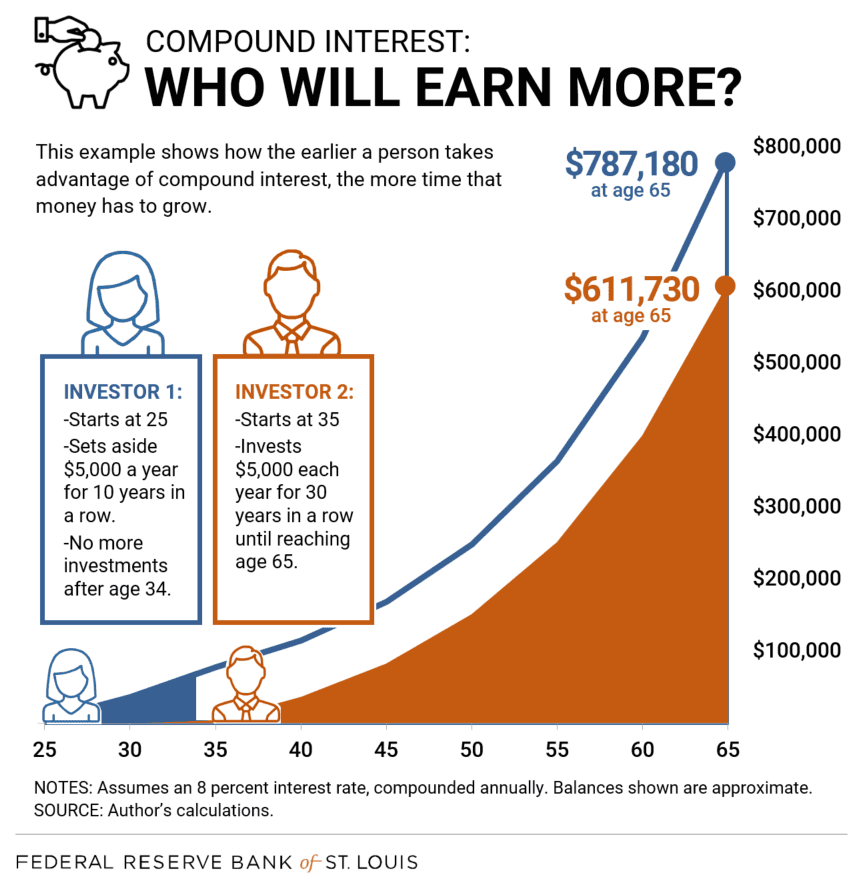

Consider the story of Alex and Blake, two friends saving for retirement.

- Alex: The Early Starter. Alex begins investing $200 per month at age 25. She earns an average annual return of 7% and stops contributing new money at age 35. In total, she contributed for 10 years, investing a total of $24,000.

- Blake: The Cautious Starter. Blake waits until age 35 to begin investing. To “catch up,” he also invests $200 per month at the same 7% average return. He contributes consistently for 30 years, until both are 65. Blake’s total contribution is $72,000.

Who has more money at age 65?

- Alex (contributed $24,000): Approximately $283,000

- Blake (contributed $72,000): Approximately $245,000

Despite investing only one-third of the capital, Alex ends up with more money than Blake. Why? Her money, specifically the early contributions, had a full 40 years to compound, while Blake’s only had 30. This is the undeniable, mathematical advantage of starting early. Procrastination is the single greatest enemy of wealth building through compounding.

Real-Life Applications: Where Can You Find Compound Interest?

Compound interest isn’t a theoretical concept; it’s actively working for or against you in numerous financial products.

- Savings Accounts and Certificates of Deposit (CDs): While currently offering lower rates, these are the safest examples of compounding. Interest is typically compounded daily or monthly.

- Retirement Accounts (401(k), IRA, Roth IRA): These are the workhorses of compound growth for most Americans. The tax-advantaged nature—either tax-deferred or tax-free growth—supercharges the compounding effect by allowing 100% of your returns to be reinvested.

- The Stock Market (via Index Funds and ETFs): When you reinvest dividends, you are directly applying the principle of compound interest. The dividends you receive buy more shares, which then generate their own dividends, creating a powerful feedback loop.

- Bonds: If you hold individual bonds or bond funds and reinvest the interest payments, you are compounding your returns.

Conversely, it’s crucial to understand that compound interest also works against you in the case of debt. Credit card debt, with its high interest rates compounded daily, can spiral out of control with the same ferocity that investments grow. This is why paying down high-interest debt is often considered the highest-return “investment” you can make.

Practical Strategies to Maximize Compound Growth

Knowing about compound interest is one thing; harnessing it is another. Here are actionable strategies to put this power to work for you immediately.

- Start Now, Not Later: Regardless of your age or the amount, begin today. Open a high-yield savings account, set up your 401(k) contribution, or fund a Roth IRA. The clock is ticking, and every day delayed is a day of lost compounding.

- Be Consistently Relentless: Set up automatic monthly transfers from your checking account to your investment or savings accounts. Consistency transforms investing from a chore into a background process.

- Reinvest All Earnings: The single most important action you can take within an investment account is to check the box that says “reinvest dividends and capital gains.” This ensures every cent of your returns goes right back to work.

- Increase Contributions Over Time: As your income grows, commit to increasing your contribution percentage. A annual 1% increase in your 401(k) contribution can have a massive impact over decades.

- Minimize Fees: High investment fees (expense ratios, advisory fees) act as a drag on your compounding returns. A 2% annual fee can consume nearly half your potential earnings over 50 years compared to a 0.25% fee. Choose low-cost index funds and ETFs whenever possible.

Frequently Asked Questions (FAQs)

1. What is the Rule of 72 and how do I use it?

The Rule of 72 is a simple mental shortcut to estimate how long it will take for an investment to double. You divide 72 by your annual rate of return. For example, at a 7% return, 72 / 7 = approximately 10.3 years. This means your money would double roughly every 10.3 years.

2. How much do I need to start investing to benefit from compound interest?

You can start with virtually any amount. Many brokerages like Fidelity, Vanguard, or Charles Schwab have no minimums for opening an IRA or for purchasing fractional shares of ETFs. The key is the habit, not the initial sum. Starting with $50 a month is infinitely better than waiting to start with $500 a month.

3. Can compound interest make me a millionaire?

Absolutely. According to data from Vanguard, if a 25-year-old invested $400 per month in a portfolio tracking the total stock market (with a historical average return around 10%), they would have over $1.6 million by age 65. The path to becoming a millionaire is often boring, consistent, and relies heavily on this principle.

4. How does inflation affect compound interest?

Inflation erodes the purchasing power of your money. For compounding to create real wealth, your rate of return must outpace the rate of inflation. This is why investing in assets like stocks, which have historically provided returns well above inflation, is often recommended for long-term goals, as opposed to keeping all your money in a low-yield savings account.

5. Is compound interest the same in a savings account vs. the stock market?

The mathematical principle is identical, but the application differs. A savings account offers a guaranteed, low rate of return. The stock market offers variable, but historically higher, long-term returns. The volatility of the market is the price you pay for that higher growth potential, which in turn leads to far more powerful compounding over decades.

6. I’m in my 40s/50s and haven’t started. Is it too late for me?

It is never too late. While starting early is ideal, the power of compounding still works over 15, 20, or 25 years. You may need to contribute more aggressively, but the principle remains your most powerful tool. Focus on what you can control now: your savings rate and your investment strategy.

7. Should I focus on paying off debt or investing?

This is a common dilemma. A general rule of thumb is to prioritize high-interest debt (e.g., credit cards over 7-8%) because the guaranteed “return” from avoiding that interest is high. For lower-interest debt (like a 3% mortgage), it may be more beneficial to invest while making regular payments, as the market’s long-term returns are likely to be higher.

8. How often should interest be compounded for the best results?

All else being equal, more frequent compounding (daily vs. annually) results in slightly higher returns due to the interest being calculated on a constantly growing balance. However, the interest rate and the time horizon are far more significant factors.

9. What is the difference between compound interest and average annual return?

The average annual return (or Compound Annual Growth Rate – CAGR) is a smoothed-out representation of your investment’s performance. Compound interest is the mechanism that creates that return over time, accounting for the ups and downs of the market.

10. Are there any online compound interest calculators you recommend?

Yes, using a calculator can be highly motivating. I recommend the following for their depth and clarity:

Conclusion: Your Journey to Financial Freedom Starts with a Single Step

The power of compound interest is not a get-rich-quick fantasy. It is a slow, steady, and certain journey to wealth creation. It rewards the disciplined, the patient, and the consistent. It democratizes financial success, making it accessible not only to the high-earner but to anyone with a plan and the will to stick with it.

You now hold the key. You understand the math, you’ve seen the stories, and you have the strategies. The most profound question now is: What will you do with this knowledge? The market will have its ups and downs, but the relentless, exponential march of compound interest, given enough time, has always prevailed. Start today. Be consistent. Reinvest everything. And watch as the eighth wonder of the world goes to work, building a future for you that is not left to chance, but is engineered by mathematical certainty.