In the landscape of American retirement planning, three account types stand as towering pillars: the 401(k) (and its siblings, the 403(b) and TSP), the Traditional IRA, and the Roth IRA. Each is a powerful, tax-advantaged vehicle designed to help you build wealth for the future. Yet, their differences—in rules, tax treatments, and strategic uses—can be a source of immense confusion.

Choosing the right account isn’t just a minor detail; it’s a fundamental decision that can impact your tax bills for decades and determine the ultimate size of your nest egg. Should you take a tax break today or a tax-free withdrawal tomorrow? Does an employer’s 401(k) match make it the undisputed champion? Can you use an IRA if you have a 401(k) at work?

This guide exists to answer these questions with clarity and depth. We will dissect each account, comparing them head-to-head on every critical factor. By the end, you will not only understand the mechanics of each but also be equipped to craft a contributions strategy that aligns perfectly with your financial situation and retirement goals.

Part 1: The Foundation – Understanding Tax Advantage

Before we compare the accounts, you must understand the two types of tax advantages they offer. This is the core of their power.

The Two Flavors of Tax Treatment

- Tax-Deferred (Traditional Model): The “Pay Taxes Later” Approach

- How it works: You contribute pre-tax dollars. This reduces your taxable income for the year you contribute. Your money grows tax-deferred. In retirement, every dollar you withdraw is taxed as ordinary income.

- Analogy: It’s like planting a seed (pre-tax contribution), letting it grow into a tree without paying taxes on the sunlight and water (tax-deferred growth), and then paying tax on the fruit you pick each year (taxed withdrawals).

- Primary Accounts: Traditional 401(k), Traditional IRA.

- Tax-Free (Roth Model): The “Pay Taxes Now” Approach

- How it works: You contribute after-tax dollars. You get no tax deduction in the contribution year. Your money grows tax-free. In retirement, your qualified withdrawals—both contributions and all the growth—are completely tax-free.

- Analogy: It’s like planting a seed you’ve already paid tax on (after-tax contribution), letting it grow into a tree without paying taxes on the sunlight and water (tax-free growth), and then harvesting all the fruit completely free of any additional tax.

- Primary Accounts: Roth 401(k), Roth IRA.

Why This Distinction is Everything: Your choice between these two models hinges on a simple question: Do you believe your income tax rate is higher today than it will be in retirement?

- If YES (higher now), the Tax-Deferred model is generally better. You get a valuable deduction now at a high rate and pay taxes later at a lower rate.

- If NO (lower now), the Tax-Free model is generally better. You “lock in” your current low tax rate and enjoy tax-free growth and withdrawals in the future.

Part 2: The Indepth Account Breakdowns

Now, let’s examine each account in detail.

The 401(k) (and 403(b)/TSP): The Workplace Workhorse

The 401(k) is an employer-sponsored retirement plan. If you work for a public school or non-profit, you likely have a 403(b). Federal government employees have the TSP (Thrift Savings Plan). For our purposes, their rules are nearly identical to a 401(k).

- Key Feature: Contributions are made through automatic payroll deductions.

- Contribution Limits (2024): $23,000 for individuals under 50. $30,500 for individuals 50 and older (includes a $7,500 “catch-up” contribution).

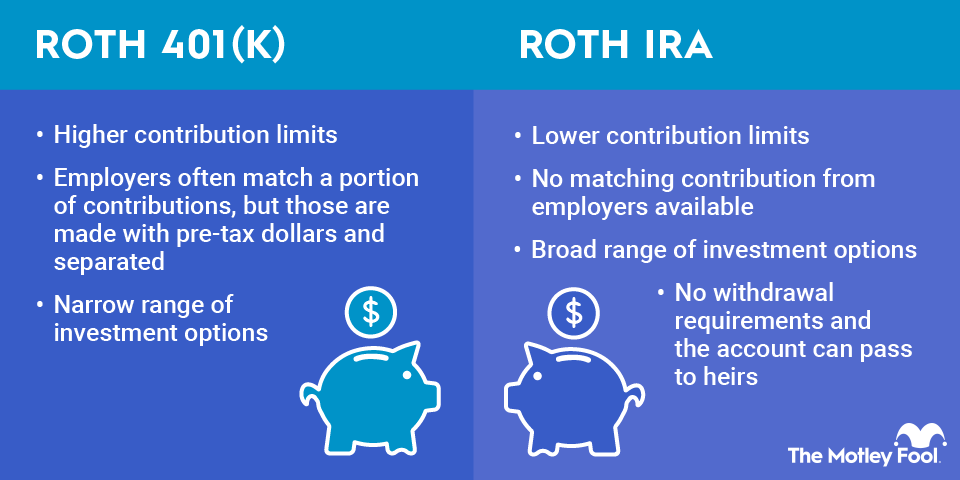

- Tax Treatment: Available in both Traditional (tax-deferred) and Roth (tax-free) versions. Many employers now offer a Roth 401(k) option.

- The Golden Handcuff: The Employer Match. This is the single most compelling reason to prioritize a 401(k). An employer match is free money. A common structure is “50% of your contributions up to 6% of your salary.” If you earn $60,000 and contribute 6% ($3,600), your employer adds $1,800. That’s an instant, risk-free 100% return on your investment.

- Investment Options: Typically limited to a menu of 15-25 mutual funds (often a mix of target-date funds, index funds, and actively managed funds) selected by your employer’s plan administrator.

- Withdrawal Rules:

- Before Age 59½: Withdrawals are subject to a 10% early withdrawal penalty on top of ordinary income tax (for Traditional). Exceptions exist for certain hardships, but they are strict.

- After Age 59½: Penalty-free withdrawals are allowed. Withdrawals from Traditional accounts are taxed as income; Roth account withdrawals are tax-free if the account has been open for at least 5 years.

- Required Minimum Distributions (RMDs): Traditional 401(k)s require you to start taking money out at age 73 (as of 2023). Roth 401(k)s are also subject to RMDs (a key difference from the Roth IRA), though you can easily avoid this by rolling the Roth 401(k) into a Roth IRA upon retirement.

Pros:

- High contribution limits.

- Potential for an employer match (free money).

- Easy, automated savings via payroll deduction.

- Roth option is available regardless of income.

Cons:

- Limited investment choices.

- Often higher fees (administrative, fund expense ratios) than IRAs.

- Roth 401(k) is subject to RMDs.

Read more: Retirement Planning in 2025: What You Need to Know

The Traditional IRA: The Individual’s Tax-Deferred Tool

An Individual Retirement Arrangement (IRA) is an account you open independently of an employer, through a brokerage like Vanguard, Fidelity, or Charles Schwab.

- Key Feature: Flexibility and individual control.

- Contribution Limits (2024): $7,000 for individuals under 50. $8,000 for individuals 50 and older (includes a $1,000 catch-up contribution). Note: This is a combined limit with the Roth IRA. You cannot contribute $7,000 to each.

- Tax Treatment: Tax-Deferred. Contributions are often tax-deductible, but this benefit phases out if you (or your spouse) are covered by a retirement plan at work and your income exceeds certain levels.

- Income Limits for Deductibility (2024):

- Single, covered by a workplace plan: Full deduction up to $77,000 MAGI; phases out between $77,000 and $87,000.

- Married Filing Jointly, covered by a workplace plan: Full deduction up to $123,000 MAGI; phases out between $123,000 and $143,000.

- No workplace plan? Deduction limits are much higher.

- Investment Options: Virtually unlimited. You can invest in stocks, bonds, mutual funds, ETFs, CDs, and more. This allows for a highly customized, low-cost portfolio.

- Withdrawal Rules:

- Before Age 59½: Subject to 10% penalty and income tax, with similar exceptions to the 401(k).

- After Age 59½: Penalty-free, but all withdrawals are taxed as ordinary income.

- RMDs: Yes, you must start taking RMDs at age 73.

Pros:

- Wide universe of investment choices, typically with lower fees.

- Potential for a tax deduction if you qualify.

- You control the account completely.

Cons:

- Low contribution limits compared to a 401(k).

- Tax deduction may be limited or eliminated by your income and workplace plan coverage.

The Roth IRA: The Tax-Free Powerhouse

The Roth IRA is the other half of the IRA family, sharing the same contribution limit but operating under the opposite tax structure.

- Key Feature: Tax-free growth and withdrawals in retirement.

- Contribution Limits (2024): $7,000 for under 50; $8,000 for 50 and older (shared with Traditional IRA).

- Tax Treatment: Tax-Free. Contributions are made with after-tax money. Qualified withdrawals are 100% tax-free.

- Income Limits for Eligibility (2024): Unlike the Traditional IRA’s deduction limits, these are hard limits on who can contribute.

- Single/Head of Household: Full contribution up to $146,000 MAGI; phases out between $146,000 and $161,000.

- Married Filing Jointly: Full contribution up to $230,000 MAGI; phases out between $230,000 and $240,000.

- Investment Options: Identical to the Traditional IRA—a vast and flexible selection.

- Withdrawal Rules:

- Contributions vs. Earnings: You can withdraw your contributions (but not earnings) at any time, for any reason, tax- and penalty-free. This provides a unique level of flexibility and access to your money.

- Qualified Distributions: To withdraw earnings tax- and penalty-free, the distribution must be “qualified”: you must be over 59½ and the account must have been open for at least 5 years.

- RMDs: None. This is a massive advantage. The money can continue growing tax-free for your entire life and can be passed on to your heirs.

Pros:

- Tax-free income in retirement.

- No Required Minimum Distributions (RMDs).

- Flexibility to access contributions early.

- Excellent for those who expect to be in a higher tax bracket later.

Cons:

- No upfront tax deduction.

- Strict income limits prevent high earners from contributing directly.

- Lower contribution limits.

Part 3: The Head-to-Head Comparison

This matrix provides a direct, at-a-glance comparison of the key features.

| Feature | 401(k) | Traditional IRA | Roth IRA |

|---|---|---|---|

| Sponsor | Employer | Individual | Individual |

| 2024 Contribution Limit | $23,000 ($30,500 50+) | $7,000 ($8,000 50+) | $7,000 ($8,000 50+) |

| Tax Deduction | Yes, for Traditional contributions | Yes, but phases out with workplace plan & high income | No |

| Tax on Growth | Tax-Deferred (Traditional) / Tax-Free (Roth) | Tax-Deferred | Tax-Free |

| Tax on Withdrawals | Taxed as income (Traditional) / Tax-Free (Roth) | Taxed as income | Tax-Free (if qualified) |

| Income Limits | No limits for contributions | Limits on deductibility | Limits on eligibility to contribute |

| Employer Match | Yes (key advantage) | No | No |

| Investment Options | Limited menu | Virtually unlimited | Virtually unlimited |

| Fees | Typically higher | Typically lower | Typically lower |

| RMDs | Yes (for both Traditional & Roth) | Yes | No |

| Early Withdrawal of Contribs. | Penalty + Tax (exceptions apply) | Penalty + Tax (exceptions apply) | Contributions can be withdrawn anytime |

Part 4: Crafting Your Contribution Strategy

Knowing the rules is one thing; knowing how to use the accounts together is the art of retirement planning. Follow this hierarchy to make the most impactful decisions.

The Golden Rule: The Employer Match

Step 1: Contribute to your 401(k) up to the full employer match.

This is non-negotiable. Turning down free money is the biggest mistake you can make. If your employer matches up to 5% of your salary, you should contribute at least 5%.

The Middle Ground: Filling the Gaps

Step 2: Max out your Roth IRA (or Traditional IRA if you qualify and prefer it).

Once you’ve captured the full match, the next priority for most people is a Roth IRA. Why?

- Superior Flexibility: The ability to access contributions and the lack of RMDs are huge benefits.

- Tax Diversification: You now have pre-tax money in your 401(k) and post-tax money in your Roth IRA. This gives you control over your tax situation in retirement.

- Better Investment Options & Lower Fees: You can build a more optimal portfolio than your 401(k) might allow.

Exception: If you are in a very high tax bracket and cannot deduct a Traditional IRA contribution, the Roth IRA is the clear winner at this step. If you are in a peak earning year and can deduct a Traditional IRA, it might be preferable.

The Advanced Stage: Maxing Out and Beyond

Step 3: Go back and max out your 401(k).

After you’ve maxed out your IRA ($7,000), return to your 401(k) and contribute up to the full $23,000 limit. The high contribution limit makes it the best tool for supercharging your retirement savings after you’ve exhausted your IRA.

Step 4: Consider a Mega Backdoor Roth (if available).

This is an advanced strategy for high earners. Some 401(k) plans allow you to make after-tax contributions (different from Roth contributions) beyond the $23,000 limit, up to a total of $69,000 in 2024. You can then immediately convert these after-tax funds to a Roth IRA. This is a complex maneuver and requires consulting with your plan administrator and a financial advisor.

Read more: The 90+ Rule of Retirement: Planning for a Longer Future

Sample Scenarios in Action

- Alex, the 25-Year-Old Starter: Alex earns $50,000. Their employer matches 100% of the first 3% of salary.

- Contribute 3% ($1,500) to the 401(k) to get the full $1,500 match.

- Open a Roth IRA and contribute the max they can afford (e.g., $3,000). They choose a Roth because they expect their income (and tax rate) to be higher in the future.

- If they have more money to save, they would increase their 401(k) contribution.

- Maria, the Peak Earner at 45: Maria earns $150,000 and is covered by a 401(k) at work. Her employer has a good match.

- She maxes out her 401(k) with pre-tax contributions ($23,000) to reduce her current high taxable income.

- She cannot contribute directly to a Roth IRA due to income limits. She explores a Backdoor Roth IRA (contributing to a non-deductible Traditional IRA and immediately converting it to a Roth IRA) to get money into the tax-free bucket.

- David and Sarah, Retiring in 5 Years: They have a mix of pre-tax 401(k) savings and a taxable brokerage account. They are now in a lower tax bracket.

- They continue 401(k) contributions to get the match.

- They shift new contributions to their Roth IRAs. They are “locking in” their current, lower tax rate to create a pool of tax-free money that won’t have RMDs, giving them more control over their retirement tax bills.

Frequently Asked Questions (FAQ)

Q1: I have a high income and am excluded from a Roth IRA. What can I do?

A: You have two excellent options:

- The Backdoor Roth IRA: This is a legitimate, two-step process where you make a non-deductible contribution to a Traditional IRA (which has no income limits) and then immediately convert that amount to a Roth IRA. You will owe taxes only on any earnings that occurred between the contribution and conversion, which is minimal if done quickly. Note: This strategy gets complicated if you have other pre-tax IRA money (the “pro-rata rule”), so consult a professional.

- The Mega Backdoor Roth: If your 401(k) plan allows it, this is an even more powerful way to get up to $46,000 ($69,000 total limit – $23,000 employee limit) into a Roth account each year.

Q2: Can I have both a 401(k) and an IRA?

A: Yes, absolutely. In fact, it’s highly recommended for most people. You can contribute to both a 401(k) and a Traditional IRA, and a 401(k) and a Roth IRA in the same year. The only combined limit is for the two IRAs—$7,000 total between a Traditional and Roth IRA.

Q3: Should I choose a Traditional or Roth 401(k)?

A: This is the classic “tax now vs. tax later” question. The general guidance:

- Choose Roth 401(k) if you are in a low tax bracket now (e.g., early in your career) or believe tax rates will be significantly higher in the future.

- Choose Traditional 401(k) if you are in a high tax bracket now and believe your retirement tax rate will be lower.

- A Split Can Be Wise: Many people choose to contribute to both, creating tax diversification within their 401(k). This gives you flexibility in retirement to decide which bucket of money to withdraw from to manage your taxable income.

Q4: What happens to my 401(k) if I leave my job?

A: You have four options:

- Leave it with your old employer’s plan (if the balance is above $5,000, they must allow this).

- Roll it over to your new employer’s plan (if allowed).

- Roll it over to an IRA. This is often the best option as it gives you full control over investments and typically lower fees. You can roll a Traditional 401(k) to a Traditional IRA and a Roth 401(k) to a Roth IRA, both tax-free.

- Cash it out. This is the worst option. The entire distribution will be subject to income tax and a 10% early withdrawal penalty if you’re under 59½, devastating your retirement savings.

Q5: I’ve heard I can use my Roth IRA as an emergency fund. Is that true?

A: Yes, with a major caveat. You can withdraw your contributions (the money you put in) from a Roth IRA at any time, for any reason, without tax or penalty. This makes it a powerful “backstop” emergency fund. However, it’s generally not ideal to plan to use it this way. The primary purpose is long-term, tax-free growth. Dipping into it disrupts your compounding. It’s better to have a separate, dedicated cash emergency fund, but the Roth IRA feature provides excellent peace of mind.

Conclusion: Your Multi-Account Retirement Blueprint

There is no single “best” retirement account. The 401(k), Traditional IRA, and Roth IRA are complementary tools, each with a unique role to play in building a secure and tax-efficient retirement.

Your optimal strategy is not static; it will evolve with your career, your income, and tax laws. The key is to understand the fundamental trade-offs and to take action. Start by capturing your employer’s match—it’s free money. Then, build your tax diversification by funding a Roth IRA. As your savings capacity grows, max out your powerful 401(k).

By strategically deploying these three pillars of the American retirement system, you move from being a passive saver to an active architect of your financial future. You gain control over your taxes, your investments, and ultimately, your freedom in retirement.