The dream of a secure and fulfilling retirement is universal, but the path to achieving it often feels shrouded in fog. Many people approach retirement planning with a vague sense of “I need to save more,” but without a clear, actionable plan, this intention can dissolve into anxiety and inaction. The chasm between a hazy retirement dream and a tangible, achievable reality is bridged by one powerful, time-tested methodology: SMART goals.

Setting SMART retirement goals transforms the monumental, lifelong project of “saving for retirement” into a series of manageable, motivating, and measurable steps. This isn’t just about picking a random number for your savings account; it’s about defining the life you want to live and building a financial and personal roadmap to get there.

This definitive guide will walk you through the process of crafting SMART retirement goals for every aspect of your future—from the financial to the personal—and provide you with the tools and strategies to not just set them, but to actually achieve them.

Part 1: Why “Save More for Retirement” Isn’t Enough: The Power of a SMART Framework

Before we dive into the “how,” it’s crucial to understand the “why.” Why does the SMART framework so dramatically increase your chances of success?

The Pitfalls of Vague Goals

Vague goals like “save more,” “be comfortable,” or “travel a bit” are doomed to fail for several reasons:

- They Lack a Finish Line: Without a specific target, how do you know when you’ve arrived? This ambiguity leads to a lack of motivation and makes it impossible to track progress.

- They Provide No Direction: “Saving more” doesn’t tell you how, where, or when to act. It’s a sentiment, not a strategy.

- They Are Uninspiring: A vague goal doesn’t spark excitement or commitment. It’s easy to ignore when daily life gets in the way.

- They Foster Anxiety: The unknown is inherently stressful. Not having a clear plan can lead to “financial phobia,” where you avoid dealing with your retirement altogether because the problem feels too large and undefined.

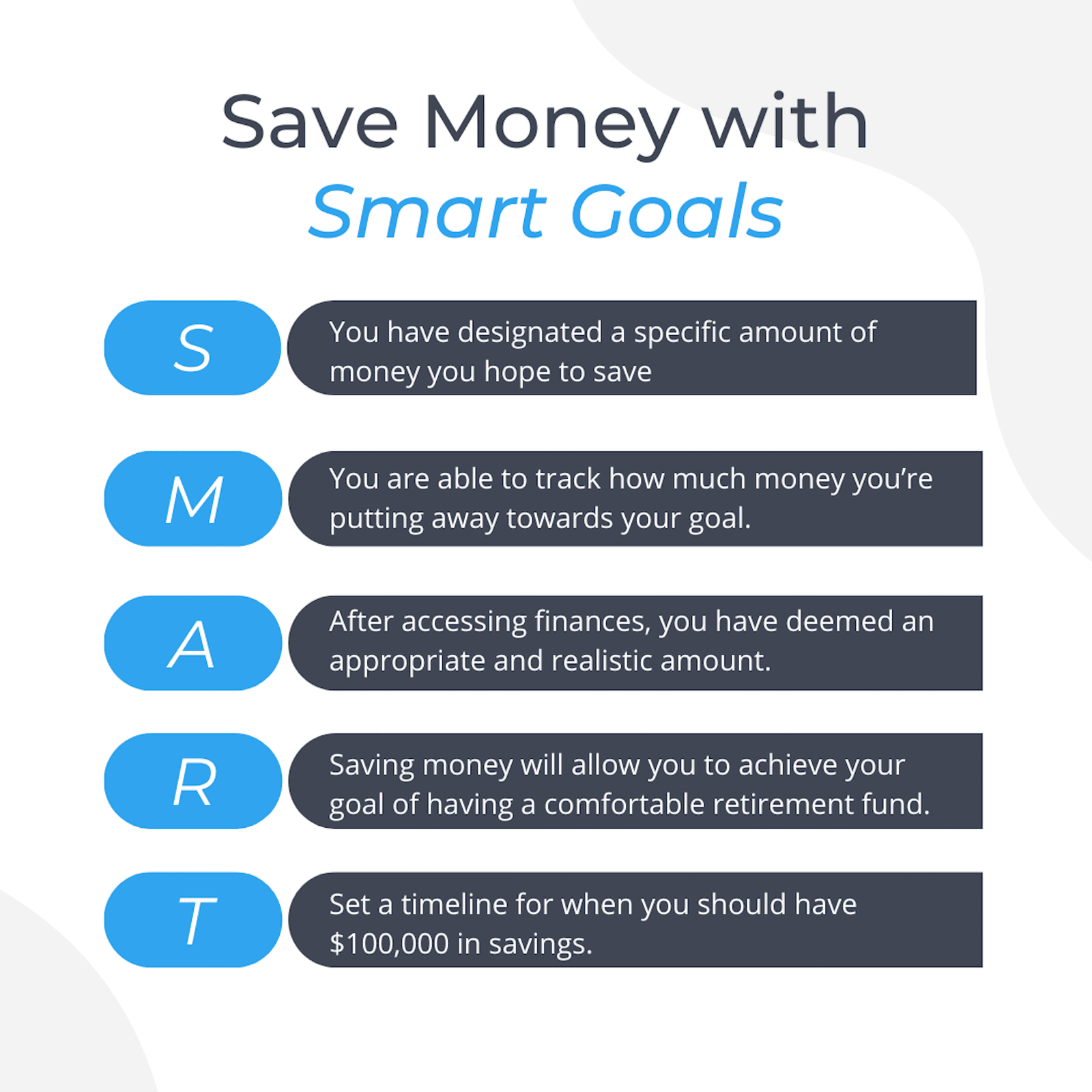

What is the SMART Framework?

The SMART acronym provides a structured checklist for creating effective goals. While slight variations exist, the core principles are:

- S – Specific: Your goal is clear, unambiguous, and answers the important questions.

- M – Measurable: You can track your progress and know when the goal is achieved.

- A – Achievable: The goal is realistic and attainable given your resources and constraints.

- R – Relevant: The goal truly matters to you and aligns with your broader life values and vision.

- T – Time-bound: The goal has a specific deadline, creating a sense of urgency.

Applying this framework to retirement planning moves you from passive hope to active, empowered management of your future.

Part 2: Deconstructing SMART for Retirement: A Step-by-Step Guide

Let’s break down each component of the SMART framework and apply it directly to the context of retirement planning.

S is for SPECIFIC: From Foggy to Focused

A specific goal drills down into the details. It moves from “I want to travel” to a vivid description of your desired reality.

Questions to Ask Yourself:

- What exactly do I want to accomplish? (e.g., “Fund my living expenses,” “Buy a retirement home,” “Pay for my grandchildren’s education.”)

- Why is this important to me? (This connects the goal to your core values.)

- Who is involved? (Just you? Your spouse? Your family?)

- Which resources are needed? (Money, time, health, knowledge?)

Vague Goal: “I want to be financially secure in retirement.”

SMART-ified Specific Component: “My spouse and I want to generate $70,000 per year (in today’s dollars) from our investment portfolio and Social Security to cover our essential living expenses and discretionary spending, allowing us to live without financial worry in a paid-off home.”

M is for MEASURABLE: Tracking Your Progress

A measurable goal attaches numbers to your ambition. What gets measured, gets managed.

Questions to Ask Yourself:

- How much?

- How many?

- How will I know when it is accomplished?

A measurable component turns a desire into a target. Using the specific example above, we now have the number $70,000 per year. But we can go deeper.

Vague Goal: “I need to save a lot of money.”

SMART-ified Measurable Component: “To generate $70,000 per year, using a conservative 4% withdrawal rate, we need a target retirement portfolio of $1,750,000. We will track our progress quarterly against this target.”

A is for ACHIEVABLE: Ambition Meets Reality

An achievable goal is stretching but not impossible. It must be within the realm of possibility given your current income, expenses, time horizon, and risk tolerance. This is where you do the hard math.

Questions to Ask Yourself:

- Do I have the financial resources (or can I acquire them) to reach this goal?

- Is this goal realistic given my time horizon until retirement?

- What constraints do I face? (e.g., debt, dependents, health issues.)

- What sacrifices am I willing to make?

Vague Goal: “I’m going to max out all my retirement accounts.” (This may not be feasible for someone with a low income and high debt.)

SMART-ified Achievable Component: “Based on our current household income of $120,000 and expenses, we can realistically increase our total retirement savings rate from 10% to 15% of our pre-tax income. This will involve cutting our dining out budget by $200 per month and redirecting annual bonuses. A financial planner has confirmed this is an aggressive but achievable target that should get us to our $1.75M goal by age 67.”

R is for RELEVANT: Connecting Money to Meaning

A relevant goal is one that you genuinely care about. It aligns with your personal values and long-term vision for your life. This is the “heart” of the goal—the part that keeps you motivated when the going gets tough.

Questions to Ask Yourself:

- Does this goal matter to me and my family?

- Is it the right time for this goal?

- Does this match my broader life plans and values?

- Am I the right person to pursue this goal?

Vague Goal: “I should probably buy a rental property for retirement income.” (But do you want to be a landlord?)

SMART-ified Relevant Component: “Achieving financial independence by 67 is relevant to us because it aligns with our core value of ‘Freedom.’ It will allow us to spend more time with our future grandchildren, volunteer for causes we care about, and pursue hobbies like woodworking and gardening without the pressure of a full-time job. The goal of a $1.75M portfolio is the engine for that freedom, making it deeply meaningful.”

Read more: Regional Spotlight: A Market Analysis of the Southern US’s Booming Economy and Investment Potential

T is for TIME-BOUND: The Power of a Deadline

A time-bound goal has a clear deadline. This creates a sense of urgency and prevents everyday tasks from taking priority over your long-term objectives.

Questions to Ask Yourself:

- When will I achieve this goal?

- What can I do today? In six months? This year?

- What is my target retirement date?

Vague Goal: “I’ll save more money someday.”

SMART-ified Time-Bound Component: “We will reach our target portfolio value of $1,750,000 by December 31st of the year we turn 67. This gives us 15 years from today. Our milestone targets are to reach $600,000 in five years and $1.1 million in ten years.”

Part 3: Putting It All Together: SMART Retirement Goal Examples

Now, let’s see the complete SMART framework in action across different areas of retirement planning.

Example 1: The Foundational Financial Goal

- Vague: “Have enough money to retire.”

- SMART Goal: “We will accumulate a $1,750,000 investment portfolio across our 401(k)s, IRAs, and brokerage accounts by age 67 (in 15 years) to generate $70,000 of annual inflation-adjusted income, supplementing our Social Security, to maintain our desired lifestyle. We will achieve this by saving 15% of our pre-tax income annually and earning an average annual return of 6%, which we will track by reviewing our portfolio balance every quarter.”

- Specific: $1.75M portfolio for $70k/year income.

- Measurable: Track portfolio balance quarterly.

- Achievable: 15% savings rate and 6% return are realistic.

- Relevant: Supports desired lifestyle and freedom.

- Time-Bound: By age 67 (15 years from now).

Example 2: A Health and Wellness Goal

- Vague: “Stay healthy in retirement.”

- SMART Goal: “To ensure we have the health and energy to enjoy an active retirement, we will both be able to hike a 5-mile moderate trail without injury by our retirement date in 10 years. We will achieve this by following a structured fitness plan, which includes walking 10,000 steps daily, strength training twice a week, and completing one progressively longer hike per month. We will schedule a bi-annual ‘fitness assessment’ hike to measure our progress.”

- Specific: Hike a 5-mile trail.

- Measurable: Steps, training sessions, monthly hikes.

- Achievable: A 10-year horizon makes this very realistic with a gradual plan.

- Relevant: Directly supports an active retirement vision.

- Time-Bound: By retirement date in 10 years.

Example 3: A “Life” and Purpose Goal

- Vague: “Find something to do in retirement.”

- SMART Goal: “Within the first six months of retiring, I will establish a part-time consulting business in my field, working no more than 10 hours per week, to provide intellectual stimulation and an extra $1,000 per month in discretionary income. I will accomplish this by networking with five former colleagues per quarter for the two years leading up to retirement and creating a business website and marketing materials in my final year of work.”

- Specific: Consulting business, 10 hrs/week, $1k/month.

- Measurable: Network with 5 colleagues/quarter, track income.

- Achievable: Leverages existing skills and network.

- Relevant: Provides purpose and “play money.”

- Time-Bound: Within first 6 months of retiring.

Part 4: The Execution Engine: How to Actually ACHIEVE Your SMART Goals

Setting the goal is only 20% of the battle. The other 80% is execution. Here’s how to build a system that ensures you follow through.

1. Break It Down into Actionable Steps

A 15-year goal can feel overwhelming. Break it down into smaller, digestible chunks.

- Long-Term (The Goal): $1.75M in 15 years.

- Medium-Term (Milestones): $600,000 in 5 years. $1.1M in 10 years.

- Short-Term (Annual): Max out IRA contributions this year. Increase 401(k) deferral by 1%.

- Immediate (This Month): Set up automatic payroll deductions to hit the annual target. Create a budget to find the extra $200/month for savings.

2. Automate Your Finances

Willpower is finite and unreliable. Automation is your best friend.

- Set up automatic contributions from your paycheck to your 401(k).

- Set up automatic monthly transfers from your checking account to your IRA or brokerage account.

- Use automated investment platforms (robo-advisors) to handle the investing.

By automating your savings, you make achieving your goal the default path. You have to actively decide to fail.

3. Schedule Regular “Retirement Check-Ups”

Your retirement plan should not be a “set-it-and-forget-it” document. Life happens.

- Quarterly: Review your investment portfolio performance and asset allocation. Are you on track with your savings rate?

- Annually: Conduct a deep-dive review. Has your income changed? Have your expenses shifted? Has your vision for retirement evolved? This is the time to adjust your SMART goals if necessary. A goal can be flexible without being abandoned.

4. Build Your Support Team

You don’t have to do this alone.

- Spouse/Partner: Ensure you are on the same page. Work on your goals together.

- Fee-Only Financial Planner: Provides expert, unbiased guidance on complex issues like tax planning, withdrawal strategies, and investment allocation. They act as an accountability partner.

- Accountability Buddy: A friend or family member who is also planning for retirement. Share your goals and progress with each other.

5. Celebrate Milestones and Practice Course Correction

The journey to retirement is a marathon, not a sprint.

- Celebrate Wins: When you hit a $100,000, $500,000, or $1,000,000 milestone, celebrate! Acknowledge the hard work and discipline it took to get there. This positive reinforcement keeps you motivated.

- Don’t Panic, Adjust: The market will drop. Life will throw you curveballs. The key is not to abandon your plan but to adjust it. If you get a raise, can you increase your savings rate? If you have a financial setback, can you temporarily reduce savings but extend your timeline? Your SMART goals are a roadmap, and it’s okay to recalculate the route when you encounter a detour.

Part 5: Beyond the Numbers: Crafting a Holistic SMART Retirement Plan

A rich retirement is about more than money. True success lies in aligning your financial resources with a fulfilling life. Use the SMART framework for these non-financial goals as well.

Sample Holistic SMART Goals:

- Relationships: “To strengthen our social connections post-retirement, my spouse and I will join one new community group (e.g., a book club or hiking group) within the first three months of retiring and host a dinner for friends at our home at least once every two months.”

- Lifelong Learning: “To keep my mind active, I will complete one online course on a subject unrelated to my former career (e.g., philosophy or photography) per year, dedicating at least two hours per week to this pursuit.”

- Legacy & Giving: “To contribute to my community, I will volunteer 5 hours per week at the local food bank, starting in the second quarter of my first year of retirement.”

Conclusion: Your Roadmap to a Confident Future

The question is no longer “How much do I need to retire?” but rather “What life do I want to build, and what are the specific, measurable, achievable, relevant, and time-bound goals I need to set to make it a reality?”

The SMART framework provides the structure to move from anxiety to action, from ambiguity to clarity. It empowers you to take control of your future, one well-defined goal at a time. The process of setting and working towards these goals is, in itself, a practice for a purposeful retirement—a life lived with intention.

Start today. Pick one area of your retirement plan, apply the SMART checklist, and write down your first goal. That single act will put you miles ahead on the path to the retirement you truly desire and deserve.

Frequently Asked Questions (FAQ)

Q1: What if my SMART goal turns out to be unrealistic?

A: This is a common and valid concern. The “A” in SMART stands for Achievable, but sometimes our initial estimates are off due to market downturns, life events, or overly optimistic assumptions. This doesn’t mean you’ve failed; it means you need to re-SMART your goal. Adjust the variables: extend your time horizon (T), lower the final target (M), or find ways to increase your savings rate (A). The goal is a guide, not a prison. Regular reviews allow for these necessary adjustments.

Q2: How often should I review my SMART retirement goals?

A: At a minimum, you should conduct a formal, comprehensive review once a year. However, a quick check-in on your progress (e.g., checking your savings rate and account balances) is wise every quarter. Any major life event—a marriage, divorce, birth of a child, job change, or inheritance—should trigger an immediate review and potential adjustment of your goals.

Q3: Can I use the SMART framework for non-financial retirement goals?

A: Absolutely! In fact, for a truly fulfilling retirement, you should. The SMART framework is incredibly effective for goals related to health (“Lose 15 pounds in 6 months to reduce blood pressure”), hobbies (“Learn to play 5 songs on the guitar within one year”), travel (“Visit three new countries in the first five years of retirement”), and social connections (“Call one long-distance friend each week”). A happy retirement is a balance of financial security and personal well-being.

Q4: How do I balance multiple SMART goals at once?

A: It’s about prioritization and integration. You likely can’t max out every retirement account, pay for a child’s wedding, and buy a vacation home all at once.

- Prioritize: Rank your goals in order of importance. Financial security (e.g., building your nest egg) is usually the non-negotiable foundation.

- Sequence: You may need to work on goals sequentially rather than simultaneously. Focus on building your core savings first, then shift cash flow to other goals later.

- Integrate: Your budget is your key tool. Allocate specific portions of your income to different goals. Automation can help here, with different automatic transfers going to different accounts for different purposes.

Q5: What’s the biggest mistake people make when setting SMART retirement goals?

A: The biggest mistake is setting the goal but not building the system to achieve it. Writing down “Save $1.75M by 67” is useless without the accompanying system of automated savings, a disciplined budget, and a regular review process. The goal provides the destination, but the system—the habits and processes you create—is the vehicle that actually gets you there.

Q6: Should I involve my spouse/partner in this process?

A: Yes, it is critically important. Retirement is a shared journey. If you and your partner have different visions or are not aligned on the financial sacrifices required, your plan is built on shaky ground. Set aside dedicated time to dream and plan together. Create shared SMART goals (“We will save…”) and individual ones (“I will pursue…”) to ensure you’re both moving in the same direction, supporting each other’s aspirations.