Imagine building a house. You wouldn’t use delicate materials for the foundation or heavy industrial beams for the interior walls. Every stage of construction requires a different approach, tailored to the specific needs and stresses of that phase.

Your investment portfolio is no different. The strategy you use to build your wealth in your 20s is fundamentally different from the one you’ll use to protect it in your 60s. This strategic framework is known as asset allocation—the single most important decision you will make as an investor.

Asset allocation is the process of dividing your investment portfolio among different asset categories, such as stocks, bonds, and cash. This isn’t about picking the next hot stock; it’s about constructing a durable, resilient portfolio designed to grow and preserve your wealth through every season of life.

This guide will walk you through the principles of age-based asset allocation, providing clear, actionable models for each decade from your 20s to your 60s. By understanding the “why” behind each allocation, you can build a portfolio that aligns with your risk tolerance and time horizon, sleep better at night during market volatility, and dramatically increase your odds of retiring comfortably.

Part 1: The Foundation – Core Principles of Asset Allocation

Before we dive into specific age-based models, we must establish the bedrock principles that govern this entire approach.

1. What Are the Core Asset Classes?

For most investors, a retirement portfolio is built on three primary asset classes:

- Stocks (Equities): When you buy a stock, you own a small piece of a company. Stocks represent the growth engine of your portfolio. They have the highest potential for long-term returns but also come with the highest volatility (sharp price swings up and down).

- Sub-categories: U.S. vs. International; Large-Cap vs. Small-Cap; Growth vs. Value.

- Bonds (Fixed Income): When you buy a bond, you are loaning money to a government or corporation. Bonds represent the stabilizing ballast of your portfolio. They provide lower returns than stocks but are generally more stable, generating income and reducing overall portfolio volatility.

- Sub-categories: Government (U.S. Treasuries) vs. Corporate; Short-Term vs. Long-Term.

- Cash and Cash Equivalents: This includes money in savings accounts, money market funds, and Certificates of Deposit (CDs). Cash is the safety net. It provides liquidity and protects your principal but offers little to no growth after inflation. In a long-term retirement portfolio, its role is typically small but crucial as you near retirement.

2. The Cornerstone Concept: Risk Tolerance vs. Time Horizon

Your ideal asset allocation is a balancing act between two critical factors:

- Risk Tolerance: This is your emotional and financial ability to withstand market declines. Would a 30% portfolio drop cause you to panic-sell, or would you see it as a buying opportunity? Be honest with yourself.

- Time Horizon: This is the length of time you expect to hold an investment before you need to sell it to fund your goals. This is the most objective and important factor in determining your allocation.

Why Time Horizon Trumps Everything (Almost):

A young investor with a 40-year time horizon can afford to be 100% in stocks because they have decades to recover from any market crash. A retiree who needs to draw income next month cannot afford that same risk. The long time horizon allows the young investor to tolerate the higher risk in pursuit of higher returns.

3. The Power of “Set It and Forget It” Investing

The goal of a sound asset allocation is not to beat the market every year. It’s to build a diversified portfolio that captures market returns at a level of risk appropriate for your age. The best way to do this is through low-cost, broad-market index funds and ETFs (Exchange-Traded Funds).

Instead of trying to pick winning stocks, you buy a fund that holds every stock in a market index (like the S&P 500 or a Total Stock Market index). This provides instant diversification, minimizes fees, and has been shown to outperform the majority of actively managed funds over the long run.

Part 2: The Decade-by-Decade Blueprint

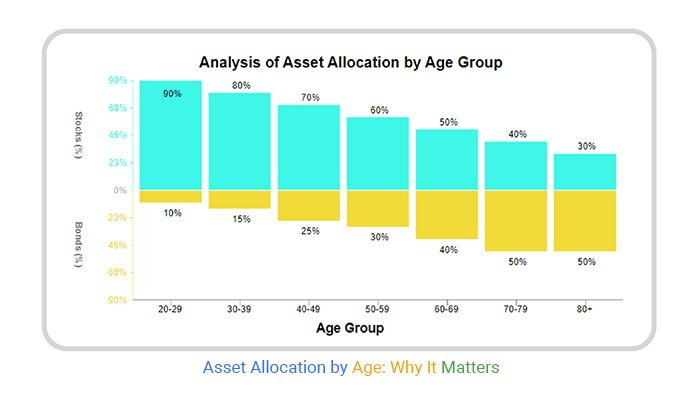

Now, let’s apply these principles to each stage of life. The following models are guidelines, not rigid rules. Adjust them based on your personal risk tolerance.

Your 20s: The Aggressive Accumulator

- Time Horizon: 40+ years until retirement.

- Primary Goal: Growth, Growth, Growth. Your greatest asset is time.

- Key Risk: Not the risk of losing money in a market crash, but the risk of being too conservative and missing out on decades of compounding.

- Suggested Allocation:90% Stocks / 10% Bonds

- 70% U.S. Total Stock Market Index Fund

- 20% International Total Stock Market Index Fund

- 10% U.S. Total Bond Market Index Fund

Strategy & Rationale:

Your 20s are for building the foundation. A 90/10 allocation is aggressive but appropriate. The 10% in bonds isn’t for safety per se; it’s a psychological anchor and a tool to practice rebalancing. When stocks fall, your bond portion will hold its value better, allowing you to “buy low” by selling some bonds to purchase more stocks during a downturn. This is a crucial habit to build early.

Action Steps for Your 20s:

- Focus on contributing consistently to your 401(k) and IRA, even if it’s a small amount.

- Automate your investments. Set up automatic contributions from your paycheck or bank account.

- Do not panic-sell! See market corrections as a fire sale for your long-term investments.

Your 30s: The Strategic Builder

- Time Horizon: 25-35 years until retirement.

- Primary Goal: Aggressive growth with a touch of stability. You may have a mortgage, a family, and higher expenses, making your financial life more complex.

- Key Risk: Being tempted to reduce risk too early or, conversely, taking on speculative risks to “get rich quick.”

- Suggested Allocation:80% Stocks / 20% Bonds

- 55% U.S. Total Stock Market

- 25% International Total Stock Market

- 20% U.S. Total Bond Market

Strategy & Rationale:

You’re in your prime wealth-building years. Your income is likely higher, allowing you to save more. The 80/20 allocation maintains a powerful growth orientation while formally introducing a meaningful stabilizing element with bonds. This 20% cushion will smooth out the ride during bear markets, preventing you from making emotional decisions when your portfolio balance is larger and the dollar-value of the drops feels more significant.

Read more: How Geopolitical Events Influence Global Markets

Action Steps for Your 30s:

- Increase your savings rate with every raise you get.

- Ensure your portfolio is globally diversified.

- Rebalance your portfolio back to its 80/20 target once a year.

Your 40s: The Peak Accumulator

- Time Horizon: 15-25 years until retirement.

- Primary Goal: Powerful growth with prudent risk management. You can see retirement on the horizon.

- Key Risk: “Sequence of Returns Risk” begins to enter the picture. A major market crash now, while you still have time to recover, can have a significant impact on your final nest egg.

- Suggested Allocation:70% Stocks / 25% Bonds / 5% Cash

- 45% U.S. Total Stock Market

- 20% International Total Stock Market

- 5% U.S. Real Estate (REITs)

- 25% U.S. Total Bond Market

- *5% Cash/Money Market*

Strategy & Rationale:

This is the decade to start deliberately de-risking your portfolio. Shifting to a 70/25/5 allocation meaningfully reduces your exposure to stock market volatility. The introduction of a small (5%) cash position serves as a dry powder reserve for opportunities and begins the transition toward the liquidity you’ll need in retirement. Some investors also add a small allocation to real estate (REITs) for further diversification.

Action Steps for Your 40s:

- Conduct a “retirement reality check.” Use a retirement calculator to see if you’re on track.

- Get more serious about rebalancing. Consider doing it semi-annually.

- Avoid “lifestyle inflation.” Channel extra income into your investments.

Your 50s: The Pre-Retirement Transition

- Time Horizon: 5-15 years until retirement.

- Primary Goal: Capital preservation and growth. The balance shifts from offense to a strong defense.

- Key Risk: A major bear market in the years immediately before or after retirement can be devastating, as you have less time to recover and will be selling assets to live on.

- Suggested Allocation:60% Stocks / 35% Bonds / 5% Cash

- 40% U.S. Total Stock Market

- 15% International Total Stock Market

- 5% U.S. Real Estate (REITs)

- 35% U.S. Total Bond Market (consider shifting some to shorter-term bonds)

- *5% Cash/Money Market*

Strategy & Rationale:

This is a critical decade for fine-tuning. The portfolio is now balanced, with a significant portion dedicated to preserving capital. You should consider “laddering” your bonds—buying bonds with different maturity dates—to reduce interest rate risk. The goal is to build a portfolio that can withstand a market downturn without derailing your retirement plans. You still need stock exposure for growth to fund a retirement that could last 30 years.

Action Steps for Your 50s:

- Take full advantage of 401(k) and IRA catch-up contributions.

- Develop a detailed retirement income plan. How will you turn your nest egg into a paycheck?

- Consider consulting a fee-only financial planner for a comprehensive review.

Your 60s: The Retirement Zone

- Time Horizon: You are now entering the distribution phase.

- Primary Goal: Generating reliable income and protecting your principal.

- Key Risk: Sequence of Returns Risk is now your #1 enemy. A large market loss in the first few years of retirement can permanently deplete your portfolio. Longevity risk (outliving your money) is also a major concern.

- Suggested Allocation (At Retirement):50% Stocks / 45% Bonds / 5% Cash

- 30% U.S. Total Stock Market

- 15% International Total Stock Market

- 5% U.S. Real Estate (REITs)

- 45% U.S. Total Bond Market (with a focus on intermediate and short-term)

- *5% Cash/Money Market* (hold 1-2 years of living expenses here)

Strategy & Rationale:

The 50/45/5 model, often called a “balanced portfolio,” is a classic for retirees. It provides enough equity exposure (50%) to provide growth that outpaces inflation over a 20-30 year retirement, while the 45% in bonds and 5% in cash provide stability and income. A crucial strategy is to hold 1-2 years of living expenses in cash or short-term bonds. This “safety bucket” ensures you never have to sell stocks during a bear market to cover your bills.

Action Steps for Your 60s:

- Finalize your Social Security claiming strategy.

- Understand Required Minimum Distributions (RMDs) from your retirement accounts.

- Implement your withdrawal strategy, starting with your cash bucket, then selling bonds and stocks (when markets are up) to replenish it.

Read more: Supply Chain Resilience: A Post-Pandemic Analysis of US Manufacturing and Logistics Networks

Part 3: Advanced Concepts and Common Pitfalls

The “120 – Your Age” Rule (and Why It’s Outdated)

You may have heard the old rule: 120 - Your Age = Stock Allocation. So, a 40-year-old would be 80% in stocks. While this is a decent starting point, it’s become overly conservative for today’s longer lifespans. A 70-year-old retiree following this rule would have only 50% in stocks, which may not provide enough growth for a retirement that could last 25+ years. The models provided above are generally more aggressive, reflecting modern realities.

The Critical Importance of Rebalancing

Rebalancing is the process of realigning your portfolio back to its target allocation. For example, if your 80/20 portfolio drifts to 85/15 after a stock market rally, you would sell 5% of your stocks and buy bonds.

Why it’s crucial: It forces you to “buy low and sell high” systematically. It removes emotion from the process and maintains your desired risk level.

How to do it: Set a calendar reminder to check your allocations every 6 or 12 months. Most 401(k) plans offer automatic rebalancing features.

Pitfalls to Avoid

- Market Timing: Trying to jump in and out of the market is a fool’s errand. “Time in the market” beats “timing the market.”

- Letting Emotions Drive Decisions: Fear and greed are the investor’s worst enemies. A solid asset allocation plan is your anchor in the storm.

- Chasing Performance: Buying what was hot last year is a great way to buy high and sell low. Stick to your plan.

- Ignoring Fees: High fees in actively managed funds can eat away 30% or more of your returns over a lifetime. Stick to low-cost index funds.

Frequently Asked Questions (FAQ)

Q1: What if I’m more risk-averse or risk-tolerant than the models suggest?

A: The models are guidelines, not commandments. The most important thing is to choose an allocation that allows you to sleep at night and stay the course. If a 90/10 allocation in your 20s gives you anxiety, a 80/20 allocation is perfectly fine. The worst thing you can do is choose an aggressive allocation and then panic-sell during a downturn. Consistency trumps optimality.

Q2: Where do Target-Date Funds fit in?

A: Target-Date Funds (or Lifecycle Funds) are an excellent “all-in-one” solution, especially for beginners. You pick a fund with a year close to your retirement date (e.g., Vanguard Target Retirement 2050 Fund), and the fund’s managers automatically adjust the asset allocation from aggressive to conservative over time. They provide instant diversification and automatic rebalancing. The main drawback is that they can be slightly more expensive than building your own portfolio with individual index funds, and they offer less customization.

Q3: How should I adjust my allocation during a market crash?

A: You should do nothing—or, if you have cash and the stomach for it, buy more. A market crash is when your asset allocation plan proves its worth. If you are rebalancing, your plan will automatically force you to sell bonds and buy stocks when stocks are “on sale.” The absolute worst thing to do is to sell your stocks in a panic. Trust your plan.

Q4: Does asset allocation change for my Roth IRA vs. my 401(k)?

A: Not really. You should view all of your retirement accounts (401(k), IRA, Roth IRA, etc.) as one unified portfolio. Your overall asset allocation is what matters. However, for tax efficiency, it’s often wise to place assets with the highest expected growth (like stocks) in your Roth IRA, since withdrawals are tax-free, and to place bonds (which generate taxable income) in your tax-deferred accounts like a Traditional 401(k). This is an advanced, but worthwhile, optimization.

Q5: I’m getting a late start on saving. Should I be more aggressive to catch up?

A: This is a common and dangerous temptation. While the desire to catch up is understandable, taking on excessive risk can backfire spectacularly. If you start late and the market crashes, you have little time to recover. A better approach is a triple-threat strategy: 1) Be slightly more aggressive than the model for your age (but not 100% stocks), 2) Dramatically increase your savings rate, and 3) Plan to work a few years longer to allow more time for contributions and compounding.

Conclusion: Your Allocation is Your Anchor

Your journey to retirement is a marathon, not a sprint. Asset allocation by age is the training plan that ensures you have the right pace and stamina for each leg of the race. It provides a logical, disciplined framework that removes guesswork and emotion from investing.

From the aggressive growth of your 20s to the careful preservation of your 60s, your portfolio is a living entity that should evolve with you. The models in this guide provide a robust starting point. The most critical step, however, is to begin. Choose an allocation that fits your age and temperament, implement it using low-cost index funds, commit to regular contributions and rebalancing, and stay the course.

By doing so, you are not just picking investments; you are building a system designed for long-term success, giving you the confidence and financial security to enjoy every chapter of your life.