Building a diversified investment portfolio is the cornerstone of prudent long-term wealth building, designed to manage risk while capturing growth. This guide demystifies the process, moving from core principles like asset allocation and correlation to actionable steps for investors at any level. You will learn to construct a portfolio aligned with your risk tolerance and timeline, utilizing a mix of stocks, bonds, ETFs, and alternative assets. We answer critical questions on rebalancing, cost management, and common pitfalls, empowering you with a strategic, disciplined framework to navigate market volatility and work toward your financial goals with confidence.

How to Create a Diversified Investment Portfolio: A 2024 Strategic Guide

The dream of financial freedom is universal, but the path to getting there is often clouded by market noise, conflicting advice, and the primal fear of loss. You’ve likely heard the old adage, “Don’t put all your eggs in one basket.” In the world of investing, this wisdom is not just a cliché—it’s the fundamental principle of diversification. But what does it truly mean to build a diversified investment portfolio in today’s complex global economy? Is it simply about owning a lot of different stocks, or is there a deeper, more strategic science to it?

This definitive guide is designed to be your comprehensive roadmap. We will move beyond theory and provide a practical, step-by-step framework for constructing a portfolio that is resilient, efficient, and tailored specifically to you. Whether you’re starting with $1,000 or re-evaluating a six-figure portfolio, understanding and applying these principles is the single most important thing you can do to enhance your potential for long-term success.

What is Investment Diversification? (And Why It’s Your Financial Safety Net)

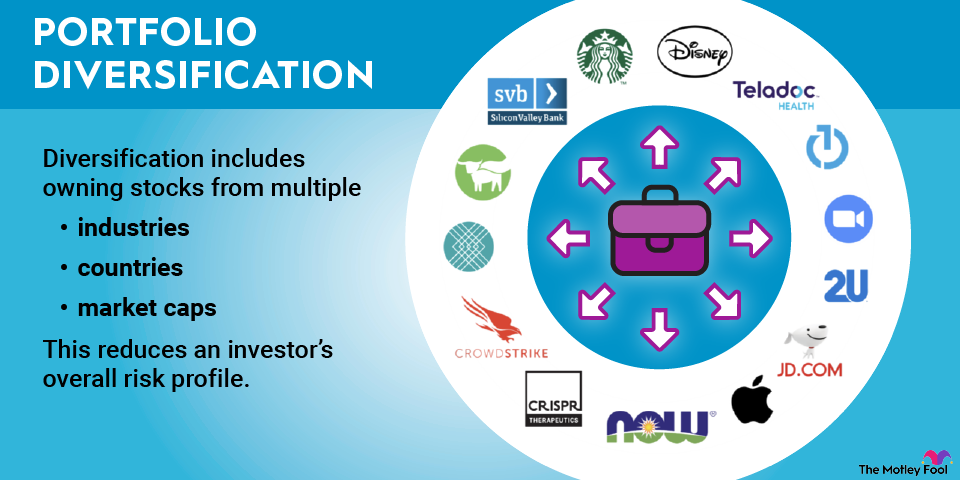

At its core, diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. The rationale is that a portfolio constructed of different kinds of assets will, on average, yield higher long-term returns and pose a lower risk than any individual investment found within the portfolio.

Think of it this way: if you invested your entire life savings in a single, promising tech company, your financial future would be inextricably linked to that one company’s fate. A groundbreaking product launch could make you wealthy, but a failed product, a scandal, or shifting industry trends could be devastating. Diversification systematically eliminates this single-point failure risk.

- The Core Mechanism: Different assets react differently to the same economic event. When geopolitical tensions rise, the price of oil might spike, hurting transportation companies but benefiting energy producers. When interest rates fall, bond prices typically rise, while growth stocks may also see a boost. By holding a mix of assets that don’t move in perfect lockstep—a concept known as low correlation—the strong performance of some investments can help neutralize the poor performance of others.

- The Data Doesn’t Lie: Legendary economist Harry Markowitz won a Nobel Prize for his Modern Portfolio Theory, which mathematically demonstrated that diversification is a “free lunch” – it allows investors to reduce risk without necessarily sacrificing expected returns. A seminal study by Vanguard found that asset allocation is responsible for over 88% of the variability of a portfolio’s returns over time, underscoring that how you divide your money is more critical than picking individual winning stocks.

The Core Pillars of a Diversified Portfolio: It’s More Than Just Stocks

A truly diversified portfolio is built on multiple layers. It’s not enough to own 50 different tech stocks; you’re still exposed to the single risk of the technology sector underperforming. Effective diversification happens across several dimensions.

1. Asset Allocation: The Foundation

This is the most critical decision you will make. Asset allocation involves dividing your investment portfolio among major asset categories like stocks, bonds, and cash. Your ideal allocation is not a random guess; it’s a direct function of your investment timeline and risk tolerance.

- Stocks (Equities): Represent ownership in companies. They offer the highest potential for growth but come with the highest level of short-term volatility.

- Bonds (Fixed Income): Represent loans you make to governments or corporations. They generally provide lower returns than stocks but act as a stabilizing ballast, paying regular interest and returning your principal at maturity.

- Cash and Cash Equivalents (e.g., Money Market Funds, Treasury Bills): Offer the highest liquidity and stability but the lowest returns, often failing to keep pace with inflation over the long run. Their primary role is for emergency funds or short-term goals.

Real-Life Example: A 25-year-old saving for retirement in 40 years has a long timeline. They can afford to take more risk, so their portfolio might be 90% stocks and 10% bonds. A 60-year-old on the verge of retirement has a much shorter timeline and cannot afford a major market crash, so their portfolio might shift to 50% stocks and 50% bonds to preserve capital.

2. Diversification Within Asset Classes

Once you’ve decided on your stock/bond split, you must diversify within those categories.

For Stocks, this means spreading your investments across:

- Market Capitalization: Large-cap (e.g., Apple, Microsoft), mid-cap, and small-cap companies.

- Geography: U.S. stocks, developed international markets (e.g., Europe, Japan), and emerging markets (e.g., India, Brazil).

- Sectors: Technology, healthcare, financials, consumer staples, energy, etc.

For Bonds, diversification includes:

- Issuer Type: U.S. Treasury bonds, municipal bonds, corporate bonds (from high-grade to high-yield “junk” bonds).

- Maturity Date: Short-term (1-3 years), intermediate-term (4-10 years), and long-term bonds (10+ years). Sh-term bonds are less sensitive to interest rate changes.

3. The Introduction of Alternative Assets

Sophisticated portfolios often include a small allocation to alternative investments to further diversify. These include Real Estate Investment Trusts (REITs), commodities (like gold), and even cryptocurrencies. Their value often moves independently of traditional stock and bond markets, providing an additional layer of protection.

A Step-by-Step Guide to Building Your Portfolio

Let’s translate these principles into a concrete, actionable plan.

Step 1: Define Your Financial Goals and Risk Tolerance

You can’t map a route without a destination. Are you investing for a 30-year retirement, a 10-year college fund for your child, or a 3-year down payment on a house? Your goal dictates your strategy.

- Ask Yourself: When will I need this money? How much can I afford to lose in the short term without panicking and selling? Many online brokers offer free risk tolerance questionnaires to help you quantify this.

Step 2: Determine Your Asset Allocation

Using your timeline and risk tolerance, establish your initial stock/bond split. Here are classic models:

- Aggressive (90/10): For long-term goals (20+ years), high-risk tolerance.

- Moderate (60/40): A balanced approach for mid-term goals (7-15 years).

- Conservative (30/70): For short-term goals (<5 years) or very low-risk tolerance.

Step 3: Select Your Investment Vehicles (The “What”)

For 99% of individual investors, the most efficient way to build a diversified portfolio is through low-cost, broad-market index funds and Exchange-Traded Funds (ETFs). Instead of picking individual stocks, you buy a single fund that holds hundreds or thousands of them.

Why Index Funds and ETFs?

They provide instant diversification, are highly transparent, and have extremely low fees (expense ratios) because they are passively managed. High fees are a major drag on long-term returns.

Sample Portfolio Construction using ETFs:

- U.S. Stocks: 45% in a fund like Vanguard Total Stock Market ETF (VTI) or iShares Core S&P 500 ETF (IVV).

- International Stocks: 25% in a fund like Vanguard Total International Stock ETF (VXUS).

- U.S. Bonds: 25% in a fund like Vanguard Total Bond Market ETF (BND).

- Real Estate & Commodities: 5% in a fund like Vanguard Real Estate ETF (VNQ) and/or Invesco DB Commodity Index Tracking Fund (DBC).

This simple four-ETF portfolio gives you exposure to thousands of securities across the globe for a minuscule cost, embodying the very essence of diversification.

Step 4: Implement Your Plan and Automate

Open a brokerage account (e.g., Fidelity, Vanguard, Charles Schwab) and execute your trades to match your target allocation. Set up automatic monthly contributions. This practice, known as dollar-cost averaging, involves investing a fixed amount regularly, which smooths out your purchase price over time and removes emotion from the process.

Step 5: Rebalance Your Portfolio Periodically

Over time, market movements will cause your portfolio to drift from its target allocation. A bull market might turn your 60% stock allocation into 70%. Rebalancing is the process of selling assets that have performed well and buying those that have underperformed to return to your original allocation.

- How to Rebalance: You can do this on a time-based schedule (e.g., annually or semi-annually) or a threshold-based schedule (e.g., whenever an asset class deviates by more than 5% from its target).

- The Benefit: It forces you to “buy low and sell high” systematically and keeps your risk level in check.

10 Trending FAQs on Portfolio Diversification

Here are direct answers to the most pressing questions American investors are asking right now.

1. How many stocks do I need to be diversified?

While a classic study suggested 30-40 individual stocks could eliminate unsystematic risk, the modern, efficient answer is one: a single, broad-market index fund like VTI holds every publicly traded U.S. stock, providing maximum diversification instantly.

2. What is the best asset allocation for my age?

A common rule of thumb is “110 minus your age” should be your stock allocation. So, a 30-year-old would have 80% in stocks. However, this is a starting point. Your personal risk tolerance is equally, if not more, important.

3. Is a 60/40 portfolio still relevant in 2024?

Yes, but its role is evolving. In a rising interest rate environment, both stocks and bonds can fall simultaneously. The 60/40 portfolio remains a solid core, but investors may consider adding a small allocation (5-10%) to alternatives like real estate or commodities for added resilience.

4. How do I diversify a small portfolio (under $10,000)?

The simplest and most effective way is through a Target-Date Fund. You pick a fund with a date close to your retirement year (e.g., Vanguard Target Retirement 2060 Fund), and it automatically handles the asset allocation and rebalancing for you, providing a complete, diversified portfolio in one fund.

5. What’s the difference between diversification and di-worsification?

“Di-worsification” is a term coined by legendary investor Peter Lynch. It refers to adding so many investments that you dilute your potential returns without meaningfully reducing risk, often by buying highly similar assets or overcomplicating your strategy. Owning 20 tech ETFs is di-worsification; owning one total market stock ETF, one international ETF, and one bond ETF is smart diversification.

6. How do I track and rebalance my portfolio?

Most major brokerages offer free tools and dashboards that show your current asset allocation. You can use these to compare against your targets. Rebalancing is as simple as placing trades to sell the “overweight” assets and buy the “underweight” ones.

7. Should I include cryptocurrencies like Bitcoin in my portfolio?

Cryptocurrencies are a highly speculative and volatile asset class. They are not suitable for everyone. If you have a high risk tolerance and a well-established core portfolio, a very small allocation (e.g., 1-3%) could be considered a speculative “satellite” holding, but it should not form the foundation of your strategy.

8. How does inflation impact my portfolio diversification?

Inflation erodes the purchasing power of cash and fixed-income returns. To combat this, ensure your portfolio has significant exposure to stocks and real assets like REITs and TIPS (Treasury Inflation-Protected Securities), which have historically acted as hedges against inflation.

9. What is the single biggest mistake people make when diversifying?

The biggest mistake is chasing past performance. Investors often pour money into the asset class that did well last year, only to buy at the peak and miss out on the next cycle’s leaders. Stick to your strategic asset allocation instead of making emotional, tactical shifts.

10. I’m feeling overwhelmed. Should I just hire a financial advisor?

If the process feels daunting or you lack the time or confidence, a fee-only fiduciary financial advisor can be an excellent investment. They are legally obligated to act in your best interest and can create, manage, and rebalance a diversified portfolio on your behalf, providing behavioral coaching to keep you on track during market downturns.

Common Psychological Pitfalls and How to Avoid Them

A perfect plan on paper is useless without the discipline to execute it. Your biggest enemy is often yourself.

- Performance Chasing: Buying what’s “hot” is a recipe for buying high and selling low. Remember, diversification means parts of your portfolio will always be underperforming others at any given time. That is the system working as intended.

- Loss Aversion: The pain of losing $1,000 is psychologically far more powerful than the pleasure of gaining $1,000. This can cause you to sell during a market panic, locking in permanent losses. Your diversified portfolio is designed for these moments; trust the strategy.

- The Solution: Write down your investment plan—including your asset allocation and rebalancing rules—and stick to it no matter what the financial news headlines say. Automate your investments and avoid checking your portfolio daily.

Conclusion: Your Journey to Financial Resilience Starts Now

Building a diversified investment portfolio is not a one-time event but an ongoing process of planning, implementation, and disciplined maintenance. It is not a secret formula for getting rich quick, but a proven, time-tested strategy for getting rich slowly and surely. It is the ultimate expression of the principle that you should focus on what you can control—your costs, your asset allocation, your behavior—and let the markets take care of the rest.

By following the steps outlined in this guide, you are not merely picking investments; you are building a robust financial system designed to weather storms and capitalize on opportunities for decades to come. Start where you are, use the tools available, and take that first step today. Your future, more secure self will thank you for it.