Article Summary: The modern economy is being reshaped by technology, from the smartphones in our pockets to the cloud computing powering our world. This guide is for the mobile-first investor who wants to understand and invest in this transformation. We’ll demystify the key sectors of the tech landscape, provide a framework for building a resilient tech-focused portfolio using individual stocks and ETFs, and outline a disciplined strategy for navigating the sector’s high-growth, high-volatility nature. You’ll learn how to leverage the very tools of the app economy—your brokerage app and financial technology—to become a savvy investor in the companies defining our future.

Introduction: You’re Already Living in the Investment Thesis

Think about your typical day. You wake up to an alarm on your iPhone, check messages on WhatsApp (owned by Meta), hail a ride with Uber, stream music on Spotify during your commute, collaborate with colleagues on Microsoft Teams, order dinner through DoorDash, and unwind by scrolling through TikTok before bed.

You are not just a user of these services; you are a firsthand witness to their economic impact, their user experience, and their cultural penetration. This daily immersion provides a unique form of market intelligence that previous generations of investors never had. The “App Economy” is no longer a niche sector—it is the bedrock of modern life and a powerful engine of the US stock market.

This guide is designed for the investor who recognizes this shift and wants to participate in it intelligently. We will move beyond simply naming popular tech stocks and delve into the how and why of building a strategic, disciplined, and risk-aware portfolio focused on US technology. The goal is not to chase fads, but to understand the foundational trends and invest in them for the long term.

Part 1: Understanding the Modern Tech Landscape – Beyond the Faang

The tech sector is vast and complex. To invest wisely, we must move beyond catchy acronyms and understand the core underlying ecosystems.

1.1. The Core Pillars of the Digital World

Modern technology is built on a stack of interdependent layers. Investing across this stack can provide diversification within the tech sector itself.

- Semiconductors: The “Picks and Shovels.” You can be agnostic about which app wins; the companies that make the advanced chips that power every computing device are essential. This includes:

- Players: NVIDIA (AI & GPU chips), AMD (CPUs & GPUs), Taiwan Semiconductor (TSM – the manufacturer for nearly everyone), ASML (the company that makes the machines that make the chips).

- Thesis: No matter which tech company thrives, they all need increasingly powerful and efficient semiconductors.

- Cloud Computing & Infrastructure: The Digital Utility. Just as the 20th century required electrical grids, the 21st runs on cloud infrastructure. Companies rent computing power, storage, and databases instead of maintaining their own servers.

- Players: Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP).

- Thesis: The migration to the cloud is still in its early innings, providing recurring, high-margin revenue for the leading providers.

- Digital Platforms & Social Networks: The Attention Economy. These companies build networks of users and monetize their engagement through advertising, commerce, and services.

- Players: Meta (Facebook, Instagram, WhatsApp), Alphabet (Google Search, YouTube), TikTok (ByteDance), X (formerly Twitter).

- Thesis: Their massive scale creates powerful moats, and their data is an incredibly valuable asset.

- Software-as-a-Service (SaaS): The Subscription Model. Software is no longer a product you buy once; it’s a service you subscribe to, creating predictable, recurring revenue.

- Players: Microsoft (Office 365, LinkedIn), Salesforce, Adobe, Shopify.

- Thesis: This model leads to strong customer loyalty, high lifetime value, and excellent profit margins.

- Digital Enablers & FinTech. The companies that facilitate the digital economy, from payments to cybersecurity.

- Players: Visa, Mastercard, PayPal, Block (Square), Cloudflare, CrowdStrike.

- Thesis: As more commerce and activity move online, the companies providing the essential plumbing become more valuable.

1.2. Megatrends as Your Investment Compass

Instead of chasing individual stock tips, anchor your research in long-term, durable megatrends.

- The Proliferation of Artificial Intelligence (AI): This is more than just chatbots. AI is being integrated into enterprise software, search engines, healthcare diagnostics, and autonomous systems. It’s a general-purpose technology, like electricity.

- The Digitization of Everything: From finance (FinTech) and healthcare (Telemedicine) to education and government services, processes that were analog are becoming digital. This trend was accelerated by the pandemic and is irreversible.

- The Future of Work: Remote and hybrid work models are cementing the need for collaboration software, cloud security, and productivity tools.

- Cybersecurity: As our lives and critical infrastructure become more digital, the need to protect data and systems from threats becomes non-negotiable, making cybersecurity a recurring essential expense.

Part 2: Your Mobile-First Investing Toolkit

Your smartphone is not just a window to the companies you’re investing in; it’s your primary portfolio management tool. Using it effectively is key.

2.1. Choosing the Right Brokerage App

The ideal app for a modern investor balances a clean, intuitive user experience with robust tools and low costs.

- Fidelity: A top-tier all-around choice. Offers a fantastic mobile app with full functionality, excellent research tools, fractional share investing, and a wide selection of ETFs and stocks with no fees.

- Charles Schwab: Similar to Fidelity, with a very powerful app, great customer service, and its own suite of low-cost index funds and ETFs.

- Vanguard: The leader in low-cost index funds. The app is functional and reliable, though some may find it less sleek than Fidelity or Schwab. Ideal for the investor who prioritizes cost above all else.

- Interactive Brokers (IBKR): For the more advanced and active investor, IBKR offers unparalleled access to global markets, advanced trading tools, and low margin rates, all within a highly capable (though more complex) mobile app.

Avoiding the Pitfalls of “Gamified” Apps: While apps like Robinhood popularized commission-free trading and a user-friendly interface, be cautious of features that can encourage impulsive behavior, like confetti animations for trades. Your investing should be deliberate, not recreational.

2.2. Leveraging Mobile Technology for Smarter Investing

- Fractional Shares: This is a game-changer. You don’t need thousands of dollars to invest in Amazon or Google. With fractional shares, you can invest $50 or $100 into a sliver of a high-priced stock, allowing for precise portfolio construction and dollar-cost averaging into any company.

- Recurring Investments: Set up automatic purchases every week or month. This automates dollar-cost averaging, ensuring you buy more shares when prices are low and fewer when they are high, all without emotional intervention.

- Push Notification Discipline: Configure alerts for company earnings reports or major price movements, but turn off daily price change notifications. Constant price updates can lead to short-term thinking and reactive decisions.

Part 3: Building Your Tech-Forward Portfolio – A Strategic Approach

A tech-focused portfolio carries higher volatility and risk. A strategic framework is essential to manage this risk while capturing growth.

3.1. The Core-Satellite Approach: A Balanced Blueprint

This is the most recommended strategy for combining stability with targeted growth.

- The Core (70-80% of your portfolio): This is your foundation, built for stability and long-term growth. It should consist of broad-market, low-cost index ETFs.

- Examples: A Total US Stock Market ETF (like VTI or ITOT) or an S&P 500 ETF (like VOO or IVV).

- Why it works: This core ensures you are capturing the overall market’s return. Even if your tech picks underperform, your portfolio remains anchored to the wider economy. It also provides dry powder to rebalance from during tech downturns.

- The Satellite (20-30% of your portfolio): This is where you express your conviction in the tech sector. This segment can be further divided:

- Satellite – Diversified Tech ETFs: For broad, lower-risk tech exposure.

- Satellite – Individual Tech Stocks: For concentrated bets on specific companies you have high conviction in.

3.2. Implementing the Satellite: A Tiered Strategy for Tech Exposure

Tier 1: Broad-Based Tech ETFs (The Foundation of Your Satellite)

These funds provide instant diversification across the entire tech sector.

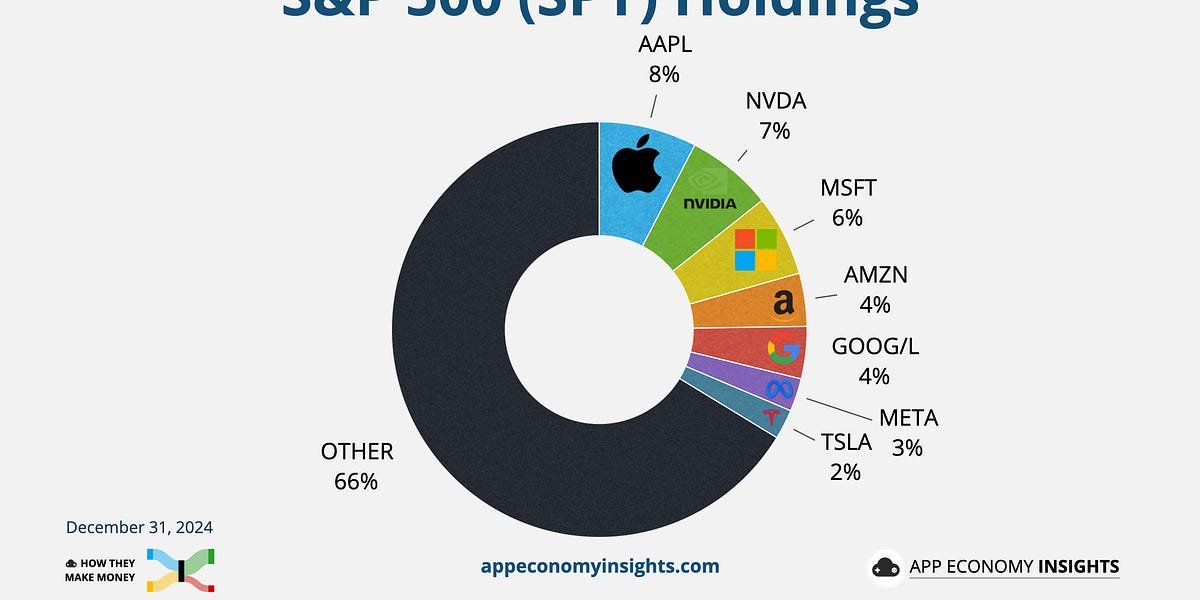

- Technology Select Sector SPDR Fund (XLK): Tracks the tech companies within the S&P 500. Top holdings include Apple, Microsoft, NVIDIA, Visa, and Mastercard. A pure, large-cap tech play.

- Vanguard Information Technology ETF (VGT): Similar to XLK but with a slightly different methodology and composition. Heavily weighted towards Apple, Microsoft, and NVIDIA.

- iShares U.S. Technology ETF (IYW): Another strong option for broad, market-cap-weighted tech exposure.

Tier 2: Thematic ETFs (Targeted Megatrends)

These allow you to bet on specific megatrends without picking a single winner.

- AI & Robotics: Global X Robotics & Artificial Intelligence ETF (BOTZ), iShares Robotics and Artificial Intelligence Multisector ETF (IRBO).

- Cloud Computing: First Trust Cloud Computing ETF (SKYY), Global X Cloud Computing ETF (CLOU).

- Cybersecurity: ETFMG Prime Cyber Security ETF (HACK), First Trust NASDAQ Cybersecurity ETF (CIBR).

- Semiconductors: VanEck Semiconductor ETF (SMH), iShares Semiconductor ETF (SOXX).

Tier 3: Individual Stock Selection (For Conviction Plays)

If you choose to invest in individual companies, a disciplined research framework is non-negotiable. Before buying, ask:

- What is the Moat? What is the company’s sustainable competitive advantage? (e.g., Apple’s ecosystem, Microsoft’s enterprise entrenchment, NVIDIA’s AI software platform).

- How is the Financial Health? Look for strong revenue growth, profitability (or a clear path to it), healthy profit margins, and a strong balance sheet (more cash than debt).

- What is the Leadership? Do you trust the vision and execution capability of the CEO and management team?

- What is the Valuation? Is the stock price reasonable relative to its earnings, growth potential, and competitors? (Using metrics like Price-to-Earnings (P/E) ratio, though this can be tricky for high-growth companies).

Read more: How to Start Investing in the USA: A Step-by-Step Guide for Beginners

Part 4: The Modern Investor’s Mindset – Navigating Volatility and Risk

Tech is not a smooth ride. It is characterized by sharp rallies and deep corrections. Your psychology will be your most valuable asset.

4.1. Embracing Volatility as a Feature, Not a Bug

- The Nature of Innovation: The tech sector is driven by disruption, which is inherently unpredictable and volatile. Expect 20-30% drawdowns (declines from peak to trough) to happen regularly. They are normal.

- The Opportunity in Downturns: For a long-term investor with a steady contribution plan, a market crash is a sale. Your recurring investments automatically buy more shares at lower prices, accelerating your wealth-building when the market recovers.

4.2. Key Risks Specific to Tech Investing

- Disruption Risk: The company that is a leader today can be rendered obsolete by a new technology or a more agile competitor. (See: BlackBerry, Nokia).

- Regulatory Risk: Large tech companies face increasing scrutiny from governments around the world regarding antitrust, data privacy, and content moderation.

- Valuation Risk: Many tech stocks are priced for perfection, with high expectations for future growth. If they miss earnings or guide lower, the punishment can be severe.

- Interest Rate Risk: Growth stocks are particularly sensitive to interest rates. When rates rise, the present value of their future expected earnings decreases, which can lead to multiple compression (a lower P/E ratio).

4.3. The Discipline of a Long-Term Horizon

The most successful tech investors are not day traders; they are business owners. They buy shares in companies they believe will be larger and more profitable in 5, 10, or 20 years. They ignore the quarterly noise and focus on the long-term trajectory of the business. Your mobile app is for monitoring and executing your long-term plan, not for daily speculation.

Part 5: A Practical Action Plan

- Open and Fund Your Account: Choose a broker from the list above (Fidelity, Schwab, or Vanguard are excellent starting points). Link your bank account and transfer funds.

- Define Your Allocation: Decide on your Core-Satellite split (e.g., 80% Core / 20% Satellite). Within your Satellite, decide how much to allocate to broad tech ETFs, thematic ETFs, and individual stocks.

- Execute Your Core: Invest the core portion of your portfolio into a broad-market ETF like VTI or VOO.

- Build Your Satellite Methodically:

- Start with a broad tech ETF like XLK or VGT for your initial tech exposure.

- As you research, you can add smaller positions in thematic ETFs or 2-3 individual companies you have the highest conviction in.

- Automate and Rebalance: Set up recurring investments into your core and satellite holdings. Once a year, review your portfolio. If your satellite has grown to become more than your target allocation (e.g., 20%), sell a portion and reinvest the proceeds into your core to rebalance. This forces you to “sell high and buy low.”

Conclusion: Becoming a Disciplined Architect of the Future

Investing in the app economy is a thrilling opportunity to participate in the most dynamic sector of our time. By using your firsthand experience as a starting point, arming yourself with knowledge of the tech landscape, and adhering to a disciplined Core-Satellite strategy, you can navigate this volatile space with confidence.

Remember, your phone is a powerful tool, but you are the strategist. Use it to execute a long-term plan, not to react to short-term fluctuations. By investing in the trends shaping our world, you’re not just building a portfolio; you’re placing a stake in the future itself.

Read more: Set It and Forget It: Building a Passive Investment Portfolio for Americans

Frequently Asked Questions (FAQ)

Q1: I’m young and have a high risk tolerance. Should I just go 100% into tech stocks?

A: While your risk tolerance may be high, the principle of diversification is fundamental. The tech sector can experience prolonged downturns (see the dot-com bust from 2000-2002, where the NASDAQ fell ~78%). A 100% concentration in any single sector, no matter how promising, exposes you to catastrophic risk. A strong core of broad-market index funds protects you and ensures you participate in the growth of the entire economy.

Q2: How many individual tech stocks should I own?

A: For most non-professional investors, owning more than 5-10 individual stocks becomes difficult to follow and manage effectively. A better approach is to use a broad tech ETF for your base exposure and then, if you wish, add 2-5 individual stocks that represent your highest-conviction ideas. This way, if one company fails, it doesn’t devastate your satellite portfolio.

Q3: What’s the difference between a company like Apple (a “tech” stock) and a company like Procter & Gamble (a “consumer staples” stock) in my portfolio?

A: The key differences are growth profile and volatility. Apple is expected to grow earnings at a faster rate than P&G, but its stock price is also much more volatile. P&G sells essential goods that people buy in any economic climate, making it more stable but with slower growth. This is why a diversified portfolio contains both types of companies—the tech for growth, the staples for stability.

Q4: How do I know when to sell a tech stock?

A: You should sell for the same reasons you bought: a change in the fundamentals. Sell if:

- The company’s competitive moat erodes.

- The financial health deteriorates significantly (e.g., rising debt, declining growth).

- The valuation becomes irrationally high and detached from any reasonable growth projection.

- You need to rebalance your portfolio back to its target allocation.

Do not sell simply because the price is down; that is often the worst time to sell.

Q5: Are there any tax considerations for trading tech stocks?

A: Yes, two major ones:

- Short-Term vs. Long-Term Capital Gains: If you sell a stock held for less than a year, profits are taxed at your higher ordinary income tax rate. Hold for over a year to qualify for lower long-term capital gains rates.

- Wash-Sale Rule: If you sell a stock for a loss, you cannot claim that loss for tax purposes if you buy a “substantially identical” security 30 days before or after the sale. This is crucial for tax-loss harvesting.

Q6: With the rise of AI, which companies are best positioned?

A: It’s helpful to think in layers:

- Infrastructure & Hardware: NVIDIA is the clear leader in AI-specific chips. Cloud providers (Microsoft Azure, Google Cloud, AWS) are essential for providing the computing power.

- Models & Platforms: Companies like Microsoft (with its partnership with OpenAI), Google (with Gemini), and Anthropic are developing the large language models.

- Application & Integration: The winners will be the companies that successfully integrate AI into their existing products to create new value, such as Adobe with its generative AI features, or Salesforce with its Einstein AI.

Q7: I’m overwhelmed by the choices. What is the absolute simplest way to get started?

A: The simplest, most effective strategy is a two-ETF portfolio:

- VTI (Vanguard Total Stock Market ETF): 90% of your portfolio. This is your core.

- XLK (Technology Select Sector SPDR Fund): 10% of your portfolio. This is your simple, diversified tech satellite.

Set up automatic monthly investments into this allocation and you will have a robust, tech-tilted portfolio that requires minimal maintenance.

Author Bio & EEAT Statement

This guide was developed by the financial research team at [Your Site Name]. Our analysis is based on continuous monitoring of the technology sector, including company financial reports, market trends, and the evolving regulatory landscape. We utilize data from reputable sources including company investor relations, financial regulators (SEC), and market research firms. The strategies outlined, particularly the Core-Satellite approach and the use of low-cost ETFs, are grounded in established principles of modern portfolio theory and long-term wealth building.

Our mission is to provide unbiased, evidence-based financial education that empowers you to make informed decisions. We do not accept payment for promoting specific stocks, ETFs, or brokerage platforms.

Disclaimer: The information provided in this article is for educational and informational purposes only and does not constitute financial, investment, or tax advice. All investments involve risk, including the possible loss of principal. The technology sector is particularly volatile. Past performance of any investment mentioned is no guarantee of future results. You should conduct your own research and consult with a qualified financial professional before making any investment decisions.

Read more: From 401(k) to FIRE: A US Investor’s Roadmap to Financial Independence