For decades, you’ve been diligently saving in your tax-advantaged retirement accounts—your 401(k), 403(b), and Traditional IRA. You’ve enjoyed the upfront tax deductions and watched your money grow tax-deferred, compounding year after year. It’s been a powerful wealth-building journey.

But this journey has a catch. The U.S. government has been a silent partner in your savings, forgoing its share of taxes all those years. And now, it’s time for them to collect.

This collection mechanism is known as the Required Minimum Distribution (RMD). It’s the government’s way of saying, “We’ve deferred these taxes long enough. It’s time to start taking this money out so we can tax it.”

For many retirees, RMDs are a source of confusion, anxiety, and unexpected tax bills. A misunderstanding of the rules can lead to one of the most draconian penalties in the entire tax code. However, with knowledge and advanced planning, you can navigate RMDs strategically, minimizing their tax impact and preserving your wealth for as long as possible.

This guide will demystify RMDs completely. We will cover the essential rules, the critical deadlines, the precise calculation methods, and, most importantly, the sophisticated strategies used by financial professionals to manage this inevitable transition from wealth accumulation to wealth distribution.

Part 1: The Foundation – What Are RMDs and Why Do They Exist?

The Basic Concept

A Required Minimum Distribution (RMD) is the minimum amount of money you are legally required to withdraw from most of your tax-advantaged retirement accounts each year, starting at a certain age. You can always withdraw more than the minimum, but if you withdraw less, you face a severe penalty.

The Philosophy Behind the Rule

The tax code provides a significant benefit by allowing your retirement savings to grow tax-deferred. The “deal” was always that you would eventually pay ordinary income tax on this money when you withdrew it in retirement, presumably when you were in a lower tax bracket.

RMDs enforce this deal. They prevent individuals from using these accounts as perpetual, tax-sheltered dynastic wealth vehicles, ensuring the taxes are paid within their lifetime.

Which Accounts Are Subject to RMDs?

It is crucial to know which of your accounts fall under RMD rules.

Accounts Subject to RMDs:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- 401(k) plans

- 403(b) plans

- 457(b) plans

- Other defined contribution plans

Accounts NOT Subject to RMDs:

- Roth IRAs (The single biggest exception! There are no RMDs for the original owner.)

- Roth 401(k) and Roth 403(b) accounts (However, note the important caveat below.)

Critical Caveat for Roth 401(k)s: While Roth IRAs have no RMDs, Roth 401(k) accounts do. This is a common and costly point of confusion. The good news is that you can easily avoid this by rolling over your Roth 401(k) funds into a Roth IRA before you are subject to RMDs. Once in the Roth IRA, the RMD requirement disappears.

Part 2: The Rules of the Game – Age, Deadlines, and Calculations

The rules for RMDs were significantly changed by the SECURE 2.0 Act of 2022. It is essential to be working with the current information.

Rule #1: When Do RMDs Begin? (The New Age Rules)

The starting age for RMDs has been pushed back.

- If you turned 73 in 2023 or later: Your RMDs begin at age 73.

- If you reached age 72 in 2022 or earlier: You were already subject to RMDs under the old rules and must continue taking them.

- The Future: For individuals born in 1960 or later, the RMD age will increase to 75.

The “First-Year” Rule: There is a special rule for your very first RMD. You have a choice:

- Take it by December 31 of the year you turn 73, or

- Delay it until April 1 of the following year. This April 1 date is known as the “Required Beginning Date.”

Warning: The Double-Up Trap! While delaying your first RMD can be tempting, it means you will have to take two RMDs in that second year—the delayed one from the previous year by April 1, and the current year’s one by December 31. This could push you into a significantly higher tax bracket for that single year. For most people, it is better to take the first RMD in the year they turn 73.

Rule #2: The Annual Deadline

For all years after your first RMD, the deadline is December 31. There are no extensions. Missing this deadline results in a harsh penalty.

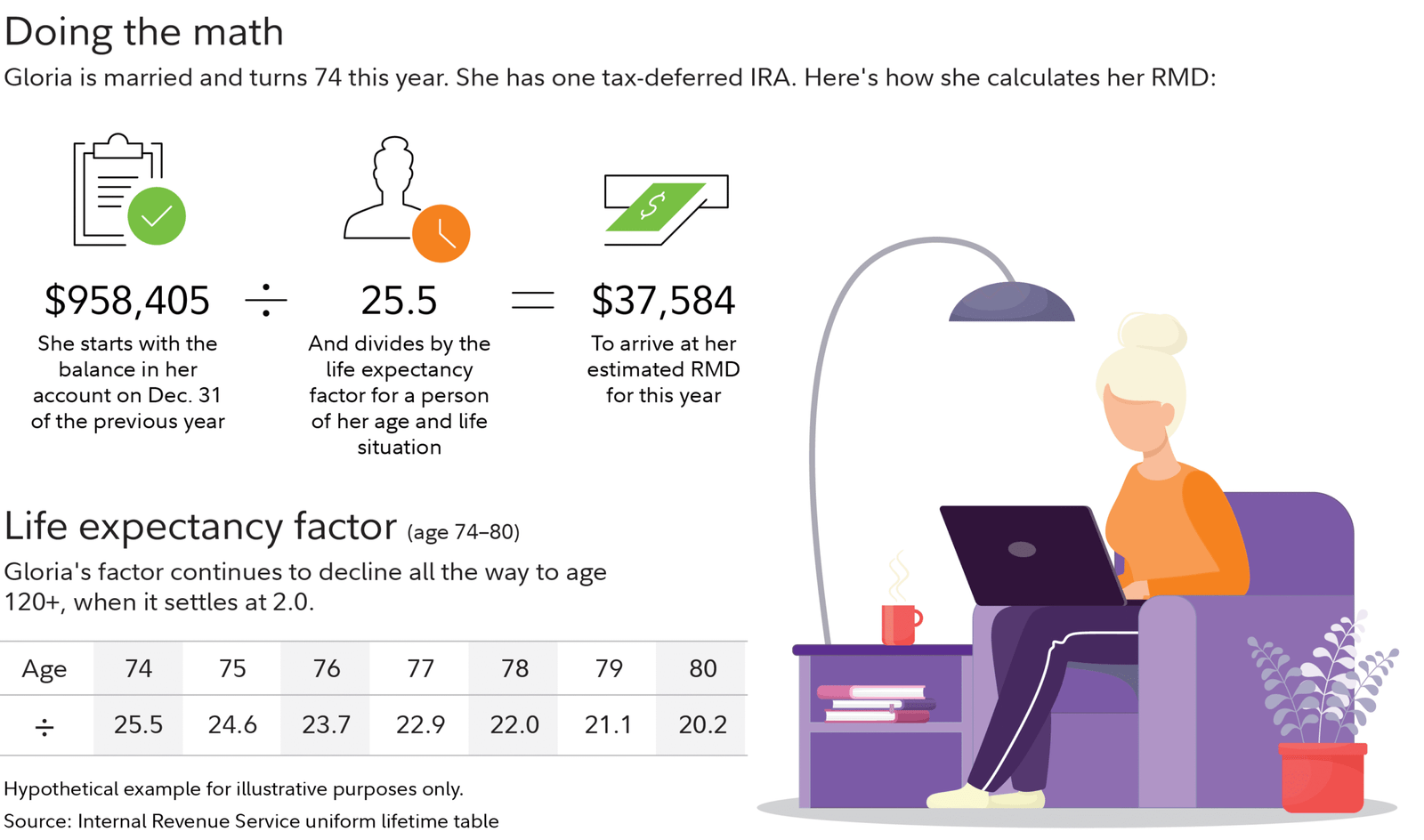

Rule #3: How Are RMDs Calculated? (The Uniform Lifetime Table)

The calculation is straightforward, but it depends on two factors:

- Your account balance as of December 31 of the previous year.

- A life expectancy factor provided by the IRS in their Uniform Lifetime Table.

The Formula:

RMD = Year-End Account Balance (from last year) ÷ Life Expectancy Factor

Understanding the Uniform Lifetime Table:

The IRS uses this table to determine a distribution period based on your age. It assumes you have a beneficiary who is 10 years younger than you. As you get older, the distribution period gets shorter, forcing you to take out a larger percentage of your account.

Example Calculation for a 75-Year-Old:

- Account Balance on Dec. 31 of previous year: $500,000

- Life Expectancy Factor for age 75 (from IRS Table): 24.6

- RMD = $500,000 ÷ 24.6 = $20,325.20

This is the minimum amount that must be withdrawn and reported as taxable income for the year.

Read more: 7 Powerful Ways AI Is Reshaping Trading Strategy in 2025 (And What Traders Must Know)

Part 3: The Grave Consequences of Getting It Wrong

The IRS does not take kindly to missed RMDs. The penalty is designed to be a significant deterrent.

The Penalty for Failure to Take an RMD

If you do not take your full RMD by the December 31 deadline, the amount not withdrawn is subject to an excise tax of 25%.

- Example: If your RMD was $20,000 and you took only $10,000, the shortfall is $10,000. The penalty would be 25% of $10,000 = $2,500.

Reduction for Timely Correction: The SECURE 2.0 Act added a provision for relief. If you correct the error in a “timely manner” (defined by the IRS) and file an amended return, the penalty may be reduced to 10%.

However, even a 10% penalty on a large RMD shortfall is a substantial and completely avoidable loss of wealth. The penalty is in addition to the ordinary income tax you will still owe on the withdrawn amount.

Part 4: Advanced RMD Strategies: Proactive Planning to Minimize Taxes

You cannot avoid RMDs, but you can strategically manage their impact. The goal is to prevent a massive spike in your taxable income during your 70s, which can trigger higher Medicare premiums, the taxation of Social Security benefits, and push you into a higher tax bracket.

Strategy #1: The Roth Conversion Ladder (The Most Powerful Tool)

This is the premier strategy for managing future RMDs, executed years before RMDs begin.

- What it is: You voluntarily convert a portion of your Traditional IRA to a Roth IRA. You pay ordinary income tax on the converted amount in the year of the conversion.

- The Benefit:

- The converted money now resides in a Roth IRA, where it grows tax-free.

- It is no longer subject to RMDs.

- You have effectively reduced the future balance of your Traditional IRA, thereby lowering your future RMDs.

- When to do it: The ideal time is in your 60s, after you’ve retired but before you start taking Social Security or RMDs. In this “low-income window,” your tax rate is often lower, making the tax cost of the conversion more affordable.

Strategy #2: Strategic Withdrawals in Your 60s

Even if you don’t need the money, consider taking voluntary withdrawals from your Traditional IRA between retirement and age 73. By systematically drawing down the balance at a controlled pace, you can smooth out your taxable income over many years and shrink the account subject to future RMDs.

Strategy #3: Qualified Charitable Distributions (QCDs) – The Secret Weapon for Philanthropy

If you are charitably inclined, the QCD is arguably the most efficient financial and tax strategy available to retirees over 70½.

- What it is: A QCD allows you to transfer up to **$105,000 (for 2024, adjusted for inflation) directly from your IRA to a qualified charity.

- The Benefits:

- The distribution counts toward your RMD for the year but is not included in your adjusted gross income (AGI).

- Because it never hits your AGI, it doesn’t increase your tax liability. It’s effectively a 100% tax-free donation.

- It can help you avoid or reduce the Income-Related Monthly Adjustment Amount (IRMAA) surcharges on your Medicare Part B and D premiums, which are tied to your AGI.

Example: You have a $30,000 RMD. You direct $10,000 via a QCD to your favorite charity. You only have to report $20,000 as taxable income from your RMD. You’ve satisfied your RMD obligation and supported a cause you care about, all while lowering your tax bill.

Strategy #4: Manage Your Asset Location

Hold investments with high growth potential (like stocks) in your Roth IRA and taxable brokerage accounts. Hold income-generating assets (like bonds) in your Traditional IRA. Since the Traditional IRA will be drained by RMDs, you want its growth to be more muted, while you want the tax-free Roth account to experience the highest possible growth.

Read more: Top 7 Revelations from the AI Investing Software Market Report 2025–2030 (Ultimate Guide)

Part 5: Special Situations and Complexities

RMDs for Inherited Retirement Accounts (The “Inherited IRA”)

The rules for inherited IRAs were drastically changed by the SECURE Act of 2019, creating a potential trap for unsuspecting heirs.

- The Old Rule (for deaths before 2020): Most non-spouse beneficiaries could “stretch” the RMDs over their own life expectancy, allowing for decades of tax-deferred growth.

- The New Rule (for deaths after 2019) – The “10-Year Rule”: Most non-spouse beneficiaries (e.g., children, siblings, friends) are now required to fully distribute the entire inherited retirement account by the end of the 10th year following the year of the original owner’s death.

- Exception for “Eligible Designated Beneficiaries”: This group can still use the life expectancy stretch. It includes:

- The surviving spouse

- A minor child of the account owner (but only until they reach the age of majority)

- A disabled or chronically ill individual

- A beneficiary who is not more than 10 years younger than the account owner

- Exception for “Eligible Designated Beneficiaries”: This group can still use the life expectancy stretch. It includes:

Action Item: If you have named non-spouse beneficiaries for your IRAs, it is critical to understand that they will face a compressed, 10-year withdrawal timeline, which could push them into high tax brackets. This may influence your own distribution and estate planning strategies.

RMDs and Multiple Accounts

The rules for aggregating RMDs differ by account type.

- IRAs (Traditional, SEP, SIMPLE): You can calculate the total RMD for all your IRAs and take the entire amount from any one or a combination of your IRA accounts. This provides significant flexibility.

- 401(k)s and 403(b)s: The RMD for each separate 401(k) or 403(b) plan must be calculated and withdrawn from that specific plan. You cannot aggregate them.

Frequently Asked Questions (FAQ)

Q1: Can I reinvest my RMDs once I take them?

A: Yes, but not back into a tax-advantaged retirement account. Once the RMD is withdrawn, it is considered taxable income. You are free to invest it in a regular, taxable brokerage account, save it in a savings account, or spend it.

Q2: What happens if my retirement account loses value? Do I still have to take an RMD?

A: Yes. The RMD calculation is based on the previous year’s December 31 balance, regardless of what the market has done since. If your account value has dropped significantly, you are still required to take the distribution, which could mean selling assets at a loss. This is a key risk during market downturns.

Q3: I’m still working at age 73. Do I have to take RMDs from my current employer’s 401(k)?

A: Possibly not. If you are still working and do not own more than 5% of the company, you can delay taking RMDs from your current employer’s 401(k) plan until April 1 of the year after you retire. This exception does not apply to IRAs or 401(k)s from previous employers. You must still take RMDs from those accounts.

Q4: How are RMDs taxed?

A: RMDs from Traditional retirement accounts are taxed as ordinary income. They are added to your other income for the year (Social Security, pension, investment income, etc.) and taxed at your marginal income tax rate. No special capital gains rates apply.

Q5: Who is responsible for calculating and ensuring I take my RMD?

A: Ultimately, you are. While many financial institutions and plan custodians will calculate your RMD for you and may even offer to automatically distribute it, the legal responsibility for taking the correct amount by the deadline rests solely with the account owner. You should always double-check the calculation yourself.

Conclusion: From Accumulation to Distribution with Confidence

Required Minimum Distributions mark a fundamental shift in your financial life—the transition from the accumulation phase to the distribution phase. While they can seem like a burden, they are a predictable event that can be managed with foresight and strategy.

Your action plan is clear:

- Know Your Deadlines: Mark your calendar for the year you turn 73 and every December 31 thereafter.

- Calculate Accurately: Use the IRS Uniform Lifetime Table and your prior year-end balance to determine your minimum withdrawal.

- Plan Proactively: Years before RMDs begin, explore Roth conversions and strategic withdrawals to smooth your tax liability.

- Leverage QCDs: If you are charitably inclined, use Qualified Charitable Distributions to satisfy your RMD tax-efficiently.

- Review Your Estate Plan: Understand the “10-Year Rule” for your beneficiaries and consider how it might affect your legacy.

By mastering the rules and implementing these strategies, you can transform RMDs from a source of anxiety into a manageable part of your retirement income plan. You can minimize your tax burden, avoid costly penalties, and ensure that your hard-earned savings continue to work for you and your heirs for as long as possible.