This in-depth report unpacks the AI investing software market from 2025 to 2030: trends, key players, growth drivers, risks, regional forecasts, use-case examples, and recommended strategies for investors and firms. It’s your authoritative, hands-on roadmap to navigate this high-stakes, fast-evolving sector.

Why the “AI Investing Software” Space Matters Now

The convergence of artificial intelligence and financial investing is no longer futuristic—it’s here. From robo-advisors powered by machine learning to predictive analytics platforms forecasting market swings, AI investing software is transforming how capital is allocated, risks are managed, and returns are generated. Between 2025 and 2030, this sector is poised to balloon, driven by institutional adoption, democratization of AI tools, and the ongoing arms race for alpha.

In this article, we take you through an elite‐level deep dive—backed by data, real examples, strategic guidance, and SEO-smart structure—to serve as your go-to reference on the AI investing software landscape in 2025–2030.

Table of Contents

- What Exactly Is “AI Investing Software”?

- Market Size & Growth Forecasts (2025 to 2030)

- Key Trends & Drivers

- Core Use Cases & Real-Life Examples

- Regional Outlook & Segment Breakdowns

- Leading Players & Emerging Startups

- Challenges, Risks & Pitfalls

- Strategic Advice for Investors & Firms

- FAQ: Top 10+ Trending Queries Answered

- Conclusion & Call to Action

1. What Exactly Is “AI Investing Software”?

Definition & Scope

- AI investing software refers to applications, platforms, or tools that leverage artificial intelligence—machine learning, deep learning, natural language processing, reinforcement learning, and more—to assist or automate aspects of investing: idea generation, portfolio allocation, risk management, trade execution, backtesting, sentiment analysis, factor modeling, and forecasting.

- It differentiates from generic “AI in finance” because its primary mission is investment decision support or automation.

- It encompasses both retail-facing (e.g. robo-advisors) and institutional-grade systems (asset managers, quantitative hedge funds, prop trading desks).

Why It’s Distinct from General AI Software

- While the wider AI software market includes everything from AI-powered CRM to computer vision platforms, the AI investing subset must adhere to strict regulatory, latency, robustness, and explainability constraints.

- Investment software must often integrate with market data, broker APIs, compliance systems, real-time feeds, risk engines, etc.—raising complexity.

2. Market Size & Growth Forecasts (2025–2030)

To make confident forecasts, we triangulate multiple sources:

- According to ABI Research, the global AI software market is expected to reach US$467 billion by 2030, growing from about US$174.1 billion in 2025 at a CAGR near 25% abiresearch.com.

- Grand View Research estimates the broader AI market (hardware + software + services) to reach USD 3,497 billion by 2033, with the software segment already commanding ~35% share in 2024

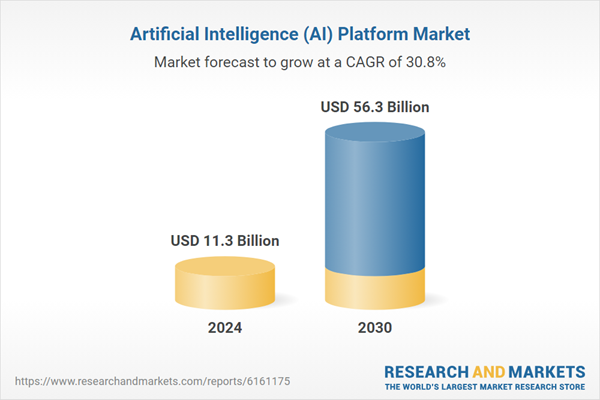

- In fintech specifically, the AI investment/robo-advisor niche is forecasted to grow at even higher rates (30–40%+ CAGR) as automation and algorithmic tools gain trust.

- A recent H1 2025 AI investment report noted that while overall VC capital is softer, deal value in AI categories surged 127% YoY as investors paid high premiums.

- Bain’s 2025 Technology Report highlights that incremental AI compute needs to scale massively (200 gigawatts expected by 2030), implying baseline demand for AI systems (including investing systems) will grow steeply.

- Goldman Sachs Research suggests that AI agents will further expand software markets, estimating that application software markets could approach $780 billion by 2030 (driven partly by AI enhancements)

Implied Estimate for AI Investing Software

Given that the broader AI software market is $174 billion in 2025 and projected ~25% CAGR, and assuming that finance/quant tools take a 5–10% share (given the capital intensity of the financial sector), the AI investing software niche could scale from $8–12 billion in 2025 to $25–40 billion by 2030, implying a CAGR in the 25–30% range. As more institutional firms adopt AI tools, that share could rise.

To be conservative, one might assume a CAGR of ~28% in this niche. If you invested $10B in 2025, that could become ~38 B by 2030.

3. Key Trends & Drivers Behind the Surge

In this period, certain forces will accelerate adoption, while others may constrain or reshape the market.

Major Drivers

- Institutional Adoption & AI Arms Race

Asset managers, hedge funds, wealth platforms—all are investing heavily to avoid being outcompeted. AI is rapidly shifting from “nice-to-have” to mission critical. - Advances in Foundation Models & Agentic AI

More powerful foundation models and autonomous agents (which can orchestrate complex workflows) will push more tasks toward automation. McKinsey highlights agentic AI as a key next frontier. - Lower Barriers to Entry (AutoML, MLOps, APIs)

New platforms make it easier for non-quant firms to deploy AI investment tools—AutoML, model marketplaces, and plug-and-play components. - Data & Alternative Data Monetization

The explosion of nontraditional data—satellite imagery, sentiment signals, ESG metrics, web scraping—gives differentiable signals that AI systems can exploit. - Cloud & Infrastructure Scaling

As AI infrastructure becomes cheaper and more distributed, even smaller players can access high compute environments. - Regulation & Transparency Pressure

As regulators mandate audit trails, fairness, and explainability, AI investing vendors that anticipate and adhere to policy will win trust. - Hybrid Human + AI Models

Many firms prefer “AI-assisted” models rather than full automation: AI generates signals, humans exercise key judgment. This “augmented intelligence” model is likely to dominate intermediate adoption phases.

Potential Constraints & Headwinds

- Overvaluation / AI Bubble Concerns

Leading financial institutions such as the Bank of England have warned of inflated AI valuations and possible sudden corrections. - Model Drift, Overfitting & Black-Box Risks

In dynamic markets, models degrade; systems relying too heavily on ML may produce spurious signals. - Data Quality & Latency Barriers

High-frequency investing demands ultra-fast, clean data. Any delay or error leads to losses. - Trust & Explainability

Especially for retail users, a black box AI that cannot explain its decisions may struggle for adoption. - Regulatory Scrutiny & Liability

As AI systems participate more actively in finance, legal and fiduciary liability issues become more salient. - Infrastructure Costs & Energy Constraints

The compute demands of training and serving large models could be a bottleneck. Bain estimates the incremental AI compute requirements rising rapidly by 2030.

4. Core Use Cases & Real-Life Examples

Understanding how AI investing software is used in practice brings clarity and credibility. Below are key use-case categories along with real or hypothetical examples.

1 Robo-Advisors & Retail AI Platforms

These are AI systems for mass-market investors that manage portfolios using algorithms.

- Wealthfront / Betterment (next-gen): Suppose they integrate a deep reinforcement learning engine that dynamically reallocates based on global macro shifts, rather than static Modern Portfolio Theory. That’s the next frontier.

- Commonwealth Bank Australia: recently piloted AI recommendation engines to suggest portfolio adjustments for customers based on sentiment and alternative data.

2 Quantitative Hedge / Prop Trading

High-frequency or quantitative alpha engines powered by AI.

- A quant fund might deploy a hybrid model: using deep nets for directional signal, and gradient boosting for factor weighting.

- Example: Renaissance Technologies (if it existed today) might incorporate emerging generative models in its ensemble stacks to capture event risk or news flows.

3 Institutional Portfolio Optimization, Risk & Allocation Tools

AI systems supporting portfolio managers and risk teams.

- BlackRock’s Aladdin already integrates quant tools; its next-gen version may ingest sentiment, ESG signals, macro forecasts from large language models.

- A multi-asset manager could use AI to test multi-dimensional stress scenarios and propose allocations adaptively.

4 Sentiment & News Analysis + Event-Driven Alpha

AI tools parsing news, social media, filings, earnings calls.

- AlphaSense / Sentieo / AmenityAnalytics: Some existing platforms do textual analysis; future versions will combine generative models for summarization and prediction of how events will move markets.

- A fund might detect emerging risks (e.g. supply-chain disruptions) early by AI scanning global news feeds.

5 Backtesting, Simulation & Scenario Generation

AI software to simulate “what-if” market regimes or explore tail events.

- Example: A platform that uses generative adversarial networks (GANs) to simulate rare crisis paths (akin to “market stress generator”) to test portfolio robustness.

- A risk team might run thousands of synthetic scenarios to evaluate drawdowns under new macro shocks.

6 Advisory & Personal Finance (Hybrid Models)

AI systems that combine investing with planning.

- A fintech app that gives users automated investment advice but also incorporates a “financial life coach” component using AI — adjusting saving, investments, insurance in an integrated model.

5. Regional Outlook & Segment Breakdowns

Adoption, regulation, and market size will differ by geography and segment.

5.1 Regional Forecasts & Trends

| Region / Market | Growth Drivers & Traits | Risks / Barriers |

|---|---|---|

| North America (U.S.) | Leader in AI investment (US private AI investment $109.1B in 2024) Stanford HAI; regulatory sophistication; institutional demand | Strong regulatory scrutiny, competition, model saturation |

| Europe | Growing regulation (AI Act), disciplined adoption; institutional demand in UK, Germany, Switzerland | More cautious risk tolerance; fragmented markets |

| Asia-Pacific | Rapid adoption in China, India; governments backing AI infrastructure | Capital constraints; regulatory ambiguity; data localization |

| Latin America & MEA | Leapfrog adoption in some fintech hubs | Infrastructure, talent constraints, currency risk |

2 Segment Breakdown

We can break the AI investing software market by:

- Deployment Model: Cloud-based (SaaS), hybrid, on-premise

- User Type: Retail / mass-market, institutional (asset managers, hedge funds), private banks

- Function: Prediction modules, optimization modules, execution modules, risk modules

- Data Type: Traditional price/fundamental data, alternative data, sentiment data

For example, cloud-based SaaS modules for predictive alpha might dominate early adoption in boutique asset managers, while giant funds may prefer hybrid or on-prem solutions for control.

6. Leading Players & Emerging Startups

Here is an illustrative—but not exhaustive—list of players operating in or entering the AI investing software domain:

- Established incumbents: MSCI, FactSet, Bloomberg, S&P Global – upgrading their platforms with AI enhancements.

- Robo-advisors & fintechs: Wealthfront, Betterment, M1 Finance, Acorns – pushing deeper AI to stay competitive.

- Quant/AI-native funds: A few hedge funds (e.g. Two Sigma, AQR’s next AI arm) may spin off software divisions.

- AI startups:

- DualEntry (recent news): raised $90 million to push AI-native ERP/financial workflow automation. Though not pure investing software, it hints at the trend of combining AI & financial domain integration.

- Future upstarts may emerge that offer modular AI investing engines for plug-in into legacy platforms.

When assessing players, look for:

- Track record and performance (alpha generation)

- Model explainability and audit tools

- API & integration capabilities

- Quality and exclusivity of data inputs

- Compliance, legal, and operational robustness

7. Challenges, Risks & Pitfalls to Avoid

Even the best-sounding AI investing platforms must navigate many risks. Below are essential caution areas:

1 Model Overfitting & Regime Change

- Many ML models show impressive backtest results, but collapse in unseen regimes.

- Real markets evolve—if your training data doesn’t cover new macro regimes, predictions fail.

- Takeaway: Always test for robustness, cross-validate across regimes, and stress-test.

2 Explainability & “Black Box” Resistance

- Users, regulators, or auditors may demand transparency.

- If an AI system can’t explain why it made a decision, trust erodes.

- Approach: Use hybrid models (interpretable + black box) or post-hoc explanation layers.

3 Data Integrity & Latency

- Bad or stale data means wrong signals. Even minor glitches can be catastrophically amplified.

- Latency in data feeds or execution can neutralize AI edge.

- Invest in quality pipelines, redundancy, error detection.

4 Regulatory Exposure & Liability

- As AI becomes more autonomous, who is responsible for errors—vendor, user, or firm?

- New rules (e.g. AI Act in Europe) may enforce transparency, fairness, and disclosure constraints.

- Also, firms must clearly document model changes and provide audit trails.

5 Overhyped Valuations & Return Expectations

- Many AI-related firms carry inflated valuations anchored on future promise rather than realized returns. The “capability realization rate” model warns of the gap between promise and performance arXiv.

- The Bank of England and other institutions have warned of AI overvaluation bubbles. The Guardian+1

- Rule: Focus on legitimate benchmarks, risk-adjusted returns, and margin sustainability rather than hype.

6 Infrastructure & Compute Costs

- Running large models, especially for real-time applications, can be expensive.

- Power consumption and cooling, GPU resources, memory constraints—all eat into margins.

- Scaling across clients often requires distributed, efficient deployment.

8. Strategic Advice for Investors & Firms (2025–2030)

If you’re planning to invest in, build, or adopt AI investing software, here are actionable strategies to maximize success:

Advice for Venture / Investment Funds

- Stage focus: early-stage AI quant platforms, middleware layers, model marketplaces.

- Due diligence: insist on live pilots, proof of strategy robustness, alpha persistence, infrastructure margins.

- Differentiated moats: exclusive data sources, domain expertise, hybrid human-AI integration.

- Exit paths: partner with incumbents (Bloomberg, MSCI) or integrate into larger financial tech stack acquisitions.

Advice for Firms / Financial Institutions

- Start with augmentation, not automation: let AI recommend, humans decide; gradually increase AI role.

- Modular deployment: adopt one module (e.g. sentiment signal) and expand as trust builds.

- Monitor model drift: build continuous retraining pipelines, recalibration, and oversight systems.

- Invest in training & talent: you’ll need AI engineers who understand finance, risk, and compliance.

- Embrace transparency & documentation: to survive audits and build client trust.

- Iterate through pilots: small internal proofs yield invaluable insights before broad deployment.

Practical Steps & Timeline (Sample Roadmap)

- Year 1 (2025–2026)

- Pilot a signal/alpha module

- Build data pipelines and backtesting systems

- Build internal governance & audit layers

- Year 2–3 (2026–2027)

- Extend to portfolio optimizer / sizing module

- Compare vs benchmarks, integrate human override

- Onboard select client uses

- Year 4–5 (2028–2030)

- Expand to full stack (prediction → allocation → execution)

- Monetize via SaaS or licensing

- Scale across geographies

10. FAQ:-

Q1: What is the projected CAGR of the AI investing software market between 2025 and 2030?

A: While exact projections vary, our triangulated estimate suggests the AI investing software niche may grow from ~$10B in 2025 to ~$25–40B by 2030—implying a compound annual growth rate (CAGR) in the ballpark of 25–30%. This is consistent with broader AI software forecasts (~25% CAGR) and the premium growth of AI in finance.

Q2: What are the top use cases for AI in investment decision-making?

A: Core use cases include robo-advisor portfolio management, quant alpha signal generation, predictive forecasting, sentiment/news analysis, backtesting / scenario simulation, and intelligent portfolio optimization. As maturity increases, AI may also drive execution strategies, real-time rebalancing, and event-driven trading.

Q3: Will AI investing software replace human portfolio managers?

A: In the near to medium term (2025–2030), it’s more likely that human roles evolve into oversight, strategy design, and exception management. AI will increasingly handle repetitive or data-heavy tasks, but firms will demand human supervision for risk, context, governance, and accountability until AI trust is fully proven.

Q4: How do regulatory frameworks affect this market?

A: Regulation is a critical shaping factor. In Europe, the upcoming AI Act will impose transparency, fairness, and audit requirements across AI systems. In the U.S., financial regulators (SEC, CFTC) may mandate model disclosure, stress testing, robust documentation, and responsibility allocation. Vendors that build compliance and interpretability from day one will gain advantage.

Q5: Are valuations in AI investing software overhyped?

A: Yes, caution is warranted. Several authorities (e.g. Bank of England) warn of inflated valuations in AI-related tech stocks, hinting at a possible “AI bubble.” The Guardian+1 Academic models like the Capability Realization Rate (CRR) underscore how market valuations often overshoot realized performance. arXiv Therefore, prudent investors should stress-test assumptions, demand live pilots, and avoid excessive leverage or multiple compression risk.

Q6: What regions will see the fastest growth in AI investing tools?

A: North America (especially the U.S.) will continue leading due to capital availability, fintech infrastructure, and regulatory clarity. However, Asia-Pacific (China, India) is likely to accelerate rapidly, driven by government backing, mobile-first fintech adoption, and leapfrog infrastructure. Europe will adopt more cautiously, given regulatory constraints.

Q7: How should small asset managers or boutiques approach AI adoption?

A: Begin with modular pilots—perhaps integrate an AI signal engine or sentiment overlay. Focus on augmentation (AI + human). Build internal model oversight, data pipelines, and governance from the start. Reinvest early profits into expanding your AI stack.

Q8: What are the biggest technical risks—model drift, latency, data?

A: Key technical risks include model overfitting to historical data, inability to adapt to new market regimes, data latency or corruption, and infrastructure failures. These risks compound in real-time trading. Investing in robust pipelines, continuous retraining, monitoring, and fallback systems is essential.

Q9: Can retail investors access institutional-level AI investing software?

A: Slowly, yes. As AI and compute costs fall, leading fintechs may offer scaled-down versions of institutional algorithms (e.g. AI-driven robo-advisors). However, retail versions will tend to prioritize simplicity, explainability, and safety.

Q10: How often do AI investing models need to be retrained or recalibrated?

A: There’s no one-size-fits-all answer. In highly volatile markets, retraining might occur daily or weekly; for slower-moving strategies, monthly or quarterly updates suffice. The key is to monitor out-of-sample performance metrics, drift indicators, and error terms, and trigger retraining when degradation passes thresholds.

Q11: What role does infrastructure and compute play in this market’s scalability?

A: A massive one. AI investing systems demand ultra-low-latency compute, robust GPU/TPU provisioning, memory architectures, and fast networking. As compute demands rise, costs, energy use, and power constraints become factors. Reports suggest that by 2030, incremental AI compute needs could reach 200 gigawatts globally, half of which may be in the U.S.—underscoring infrastructure pressures. Bain

11. Conclusion & Call to Action

The period from 2025 to 2030 is shaping up to be a pivotal decade for AI investing software. What starts now as experimentation and augmentation will evolve into mission-critical systems used by asset managers, hedge funds, fintechs, and wealth platforms. The winners will be those who combine:

- Anchored, defensible alpha (not hype),

- Transparent, auditable models,

- Seamless integration into existing workflows,

- Regulatory foresight, and

- Scalable infrastructure.

If you’re an investor or technologist, now is the time to position into this space—via partnerships, early pilots, talent acquisition, and selective investment into modular systems.